Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Monthly Market Review

By Nathan Sonnenberg

AdvicePeriod Chief Investment Officer

September has developed a reputation as the toughest month for stocks, and last month did not disappoint, as all major market indexes declined sharply.

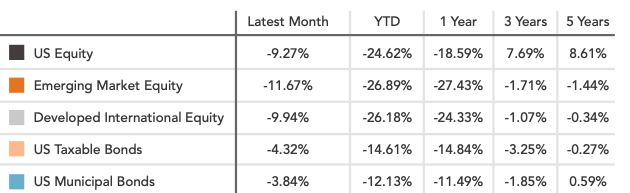

The S&P 500 ended the month down 9.2%, while the Dow Jones Industrial Average declined 8.8%. The technology-heavy Nasdaq 100 Index lost 10.6%, while global equities, as measured by the MSCI ACWI Index, were off 9.6%. Meanwhile, U.S. bond prices, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, fell 4.3%, and the S&P National AMT-Free Muni Index, gauging municipal bond prices, declined 3.3%.

Markets started September strong, but bad news on inflation reversed their momentum. Both stocks and bonds have now declined for a record three consecutive quarters, as high inflation and interest rates have proven to be powerful headwinds. Stubbornly high inflation—currently 8.3% for the most recent 12 months—has forced the Federal Reserve to raise interest rates sharply. The central bank on September 21 announced its third straight .75% increase. The central bank has now hiked interest rates 3% in 2022, creating a more difficult business environment.

A contributing factor to stocks’ difficulties has been the strength of the U.S. dollar. The greenback has risen 13% versus the euro this year, 25% compared with Japan’s yen and 12% against the Chinese yuan. A strong dollar is good news for U.S. consumers because it makes imports cheaper, but it hurts U.S. multinational corporations, which lose money when they convert foreign earnings into dollars.

One piece of good news is that the U.S. is likely not in a recession. Although real gross domestic product decreased 0.6% in the second quarter and 1.6% in the first, the Atlanta Fed projects that the economy grew 2.7% in the third quarter. There is some indication that consumer inflation may have peaked: The prices paid by companies have declined for six straight months. Food prices have fallen for five consecutive months. Supply chain bottlenecks are disappearing, and oil and gas prices are back at early 2022 levels.

What’s more, rising interest rates have started to cool off the red-hot housing market. The average 30-year mortgage rate has more than doubled since the end of 2021 to 6.7%. That helps account for slight declines in home prices in July and August.

But we’re not out of the woods yet. One reason is that U.S. employment has proven remarkably resilient. Employers created 263,000 new jobs in September, knocking the unemployment rate from 3.7% to 3.5%. What’s more, average wages have risen 5% over the past 12 months. While this is good news for workers, it could also prolong strong consumer spending, which in turn could fuel continued inflation. And that could force the Fed to remain aggressive longer than anticipated.

Looking ahead, markets will be keenly interested in the next inflation update, which is scheduled for October 13. Barring a surprise, it’s anticipated that the Federal Reserve will raise interest rates by another 0.5% to 0.75% at its November 2 meeting. The Fed has signaled that it intends to raise rates twice by year-end. And of course, all eyes will be on corporate earnings releases during October.

There’s no doubt the markets have tested investors so far in 2022. The good news is that investors’ patience is usually rewarded. From 1930 through 2021, the S&P 500 has posted twice as many positive annual returns (62) as negative ones (30). In the cyclical patterns of the market, falling prices have historically set the stage for future gains. For wise investors, this is the time to remain disciplined and maintain a mix of investments suited to your goals, timetable and tolerance for risk. Don’t hesitate to contact your wealth advisor with any questions.

Definitions:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Dow Jones Industrial Average (DJIA) is an index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The Nasdaq 100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization.

The MSCI All Country World Index (ACWI) is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed and emerging market countries.

The Bloomberg U.S. Aggregate Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities.

The S&P National AMT-Free Municipal Bond Index is a broad, comprehensive, market value-weighted index designed to measure the performance of the investment-grade tax-exempt U.S. municipal bond market.

Disclosures:

The indices referenced are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary represents an assessment of the market environment through September 2022. The views and opinions expressed may change based on market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

The commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. Please consult a financial professional before making any financial-related decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Does past performance matter?

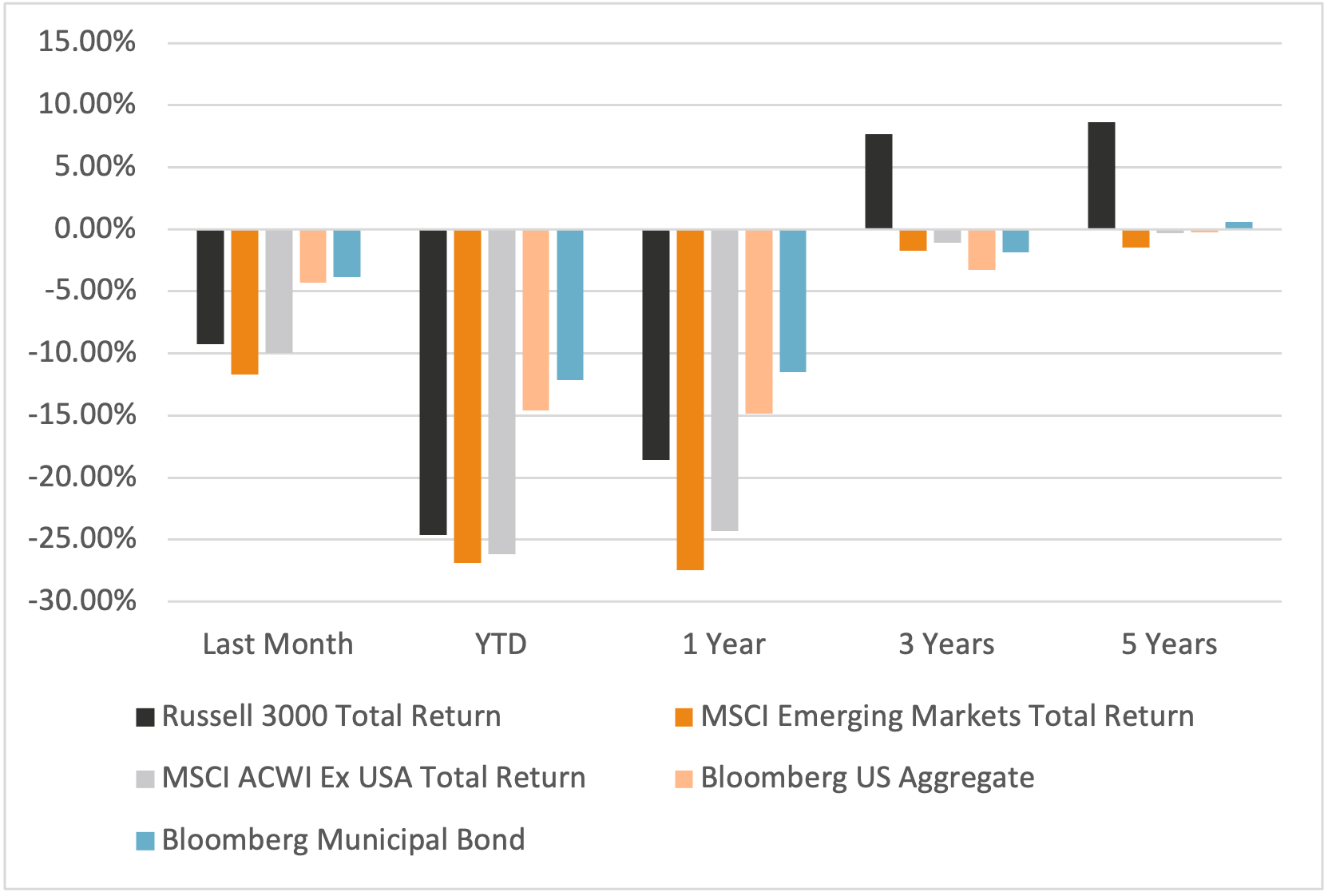

Major Market Index Returns

Period Ending 10/1/2022

Multi-year returns are annualized.

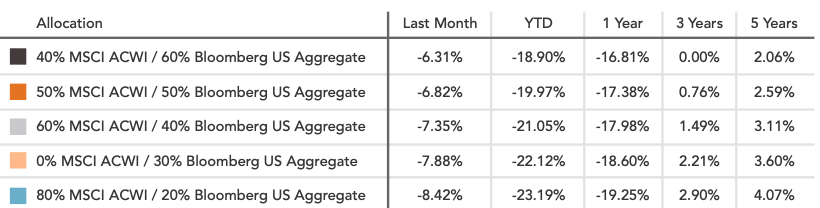

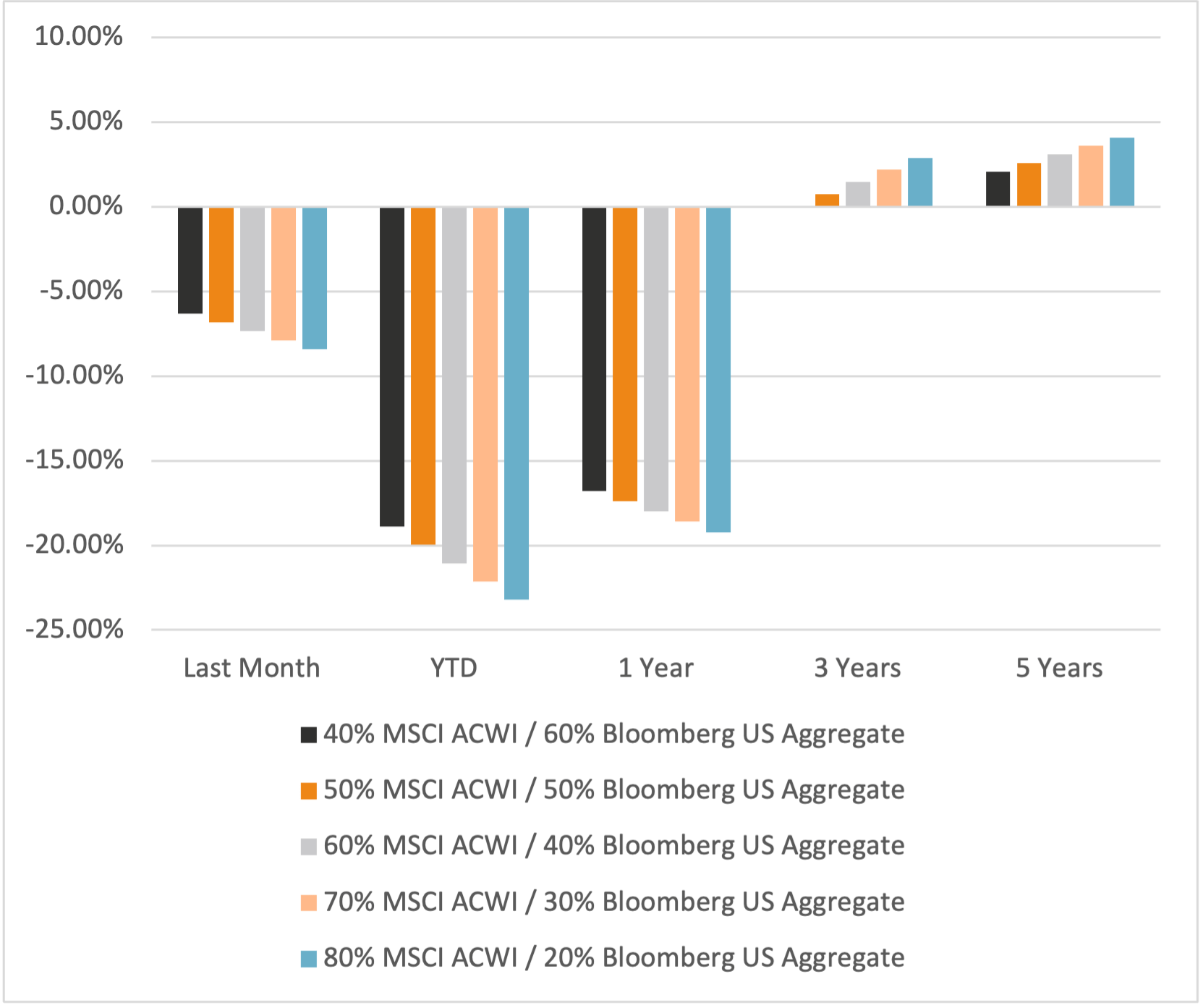

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

What You Pay For: The Percentage of Active Managers That Underperform Their Benchmarks

Trailing 10 Years Numbers As of December 31st, 2021 – S&P Spiva Scorecard

Percentage of US large-cap funds that underperformed their benchmarks

US large-cap benchmark:

S&P 500

Percentage of international funds that underperformed their benchmarks

International benchmark:

S&P International 700

Percentage of emerging market funds that underperformed their benchmarks

Emerging Markets benchmark:

S&P/IFCI Composite

The SPIVA Scorecard is a robust, widely-referenced research piece conducted and published by S&P DJI that compares actively managed funds against their appropriate benchmarks on a semiannual basis.

April 2024 Market Commentary