Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Monthly Market Review

By Nathan Sonnenberg

AdvicePeriod Chief Investment Officer

November marked a second straight month of strong gains for stocks while bonds rose as well.

The S&P 500 ended the month up 5.6% while the Dow Jones Index of 30 stocks gained 6%. The tech-heavy Nasdaq 100 index, meanwhile, rose 5.6%. Global equities turned in solid performance as well, with the MSCI All-Country World Index rising 7.8%. Bonds, as reflected by the Bloomberg U.S. Aggregate Bond Index, gained 3.7%. The S&P National AMT-Free Municipal Bond Index rose by 4.7%.

U.S. stocks faced competition in November from safe, increasingly attractive fixed income alternatives. Some money market funds now yield upwards of 4% while short-term Treasury bills are yielding nearly 5%. But that pressure on stocks was offset by a number of tailwinds. The U.S. dollar reversed a yearlong surge in November, dropping by a sharp 5%. A weakening dollar helps U.S.-based companies that generate significant sales abroad because it means their foreign revenues are worth more when they’re converted into dollars.

Corporate earnings, meanwhile, have continued to defy widespread worries. With the third quarter earnings season now behind us, 70% of S&P 500 companies reported earnings per share above estimates. It’s noteworthy, however, that the earnings growth rate of 2.4% was the lowest in two years.

But perhaps the biggest factor in the month’s market performance was the continuation of encouraging inflation signals. Early in the month, the Federal Reserve announced a fourth consecutive .75% interest-rate hike as it continued its campaign to rein in four-decade-high price increases. There’s growing evidence that it’s working, which could allow the Fed to pivot to a less-aggressive interest-rate policy in the near future.

The prices paid by companies have declined for eight straight months. Food prices and supply chain bottlenecks have stabilized. Oil and natural gas prices are well off their first quarter highs. The inflation picture isn’t completely rosy, though; concerns remain about stubbornly high wage growth and persistent rent increases, as well as the possibility of energy price shocks.

Meanwhile, the market’s fears of an economic recession have yet to be borne out. Third-quarter gross domestic product expanded by 2.9% on an annualized basis, and the Atlanta Fed projects fourth-quarter growth of 2.8%. Job growth remains robust, with total nonfarm payroll employment increasing by 263,000 in November and unemployment holding stable at 3.7%.

Investors are looking ahead to mid-December: Fresh data on inflation will be released as the Fed convenes to make an interest-rate decision. The central bank has signaled that a rate hike is in the cards; the question is whether it will prescribe another .75% increase or ease off of that number.

Despite stocks’ and bonds’ recent gains, this year has been a challenging one. Both asset classes remain down by double digits. The good news is that these valuation resets should help create the conditions for future positive returns. We believe, staying in the market despite volatility continues to be critical for long-term investors. Example: Had an investor in the S&P 500 panicked in mid-October and sold their position, they’d have missed out on a nearly 14% gain through the end of November. As always, successful investing means patiently maintaining a diversified portfolio that reflects your goals, time horizon and tolerance for risk.

Definitions:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Dow Jones Industrial Average (DJIA) is an index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The Nasdaq 100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization.

The MSCI All Country World Index (ACWI) is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed and emerging market countries.

The Bloomberg U.S. Aggregate Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities.

The S&P National AMT-Free Municipal Bond Index is a broad, comprehensive, market value-weighted index designed to measure the performance of the investment-grade tax-exempt U.S. municipal bond market.

Disclosures:

The indices referenced are unmanaged and cannot be directly invested into. Past performance and yields referenced is no indication of future results. Investing involves risk and the potential to lose principal.

Diversification is an investment strategy designed to help manage risk, but it cannot ensure a profit or protect against loss in a declining market.

An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. Investors should consider the investment objective, risks, charges, and expenses carefully before investing. The prospectuses for the fund contain important information which should be read carefully before investing.

This commentary represents an assessment of the market environment through November 2022. The views and opinions expressed may change based on market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

The commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. Please consult a financial professional before making any financial-related decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Does past performance matter?

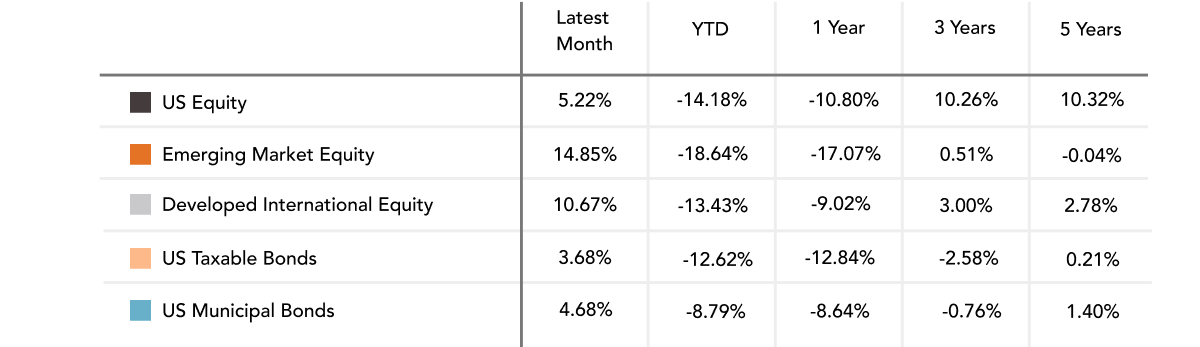

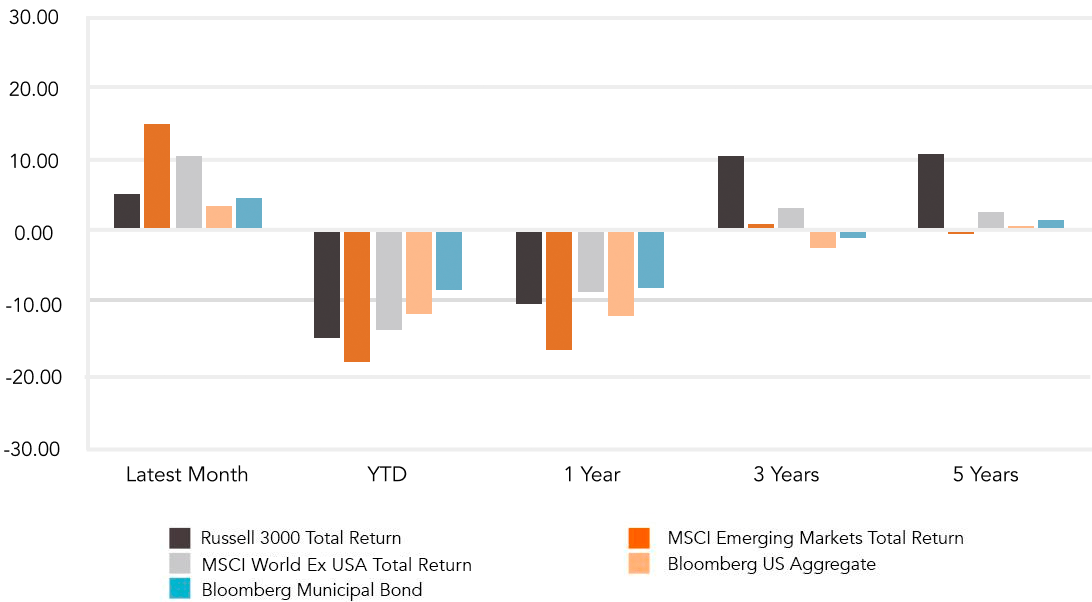

Major Market Index Returns

Period Ending 12/1/2022

Multi-year returns are annualized.

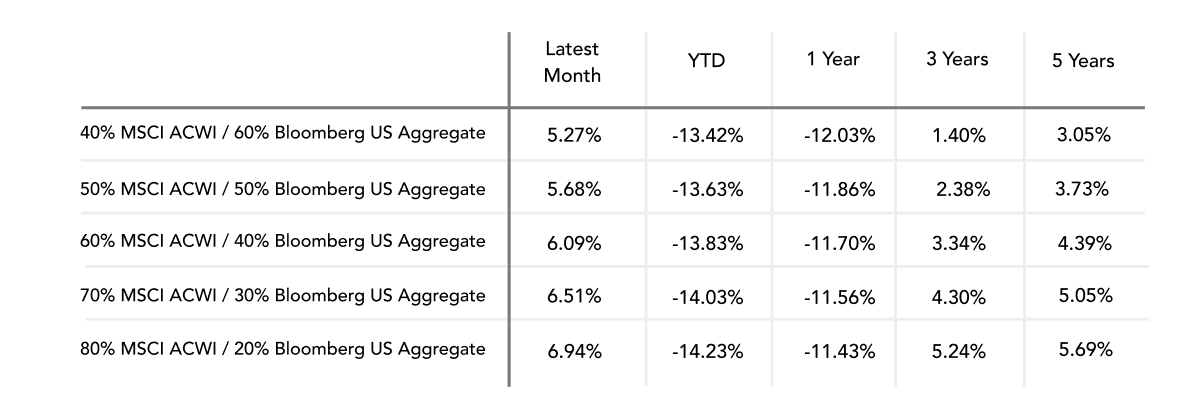

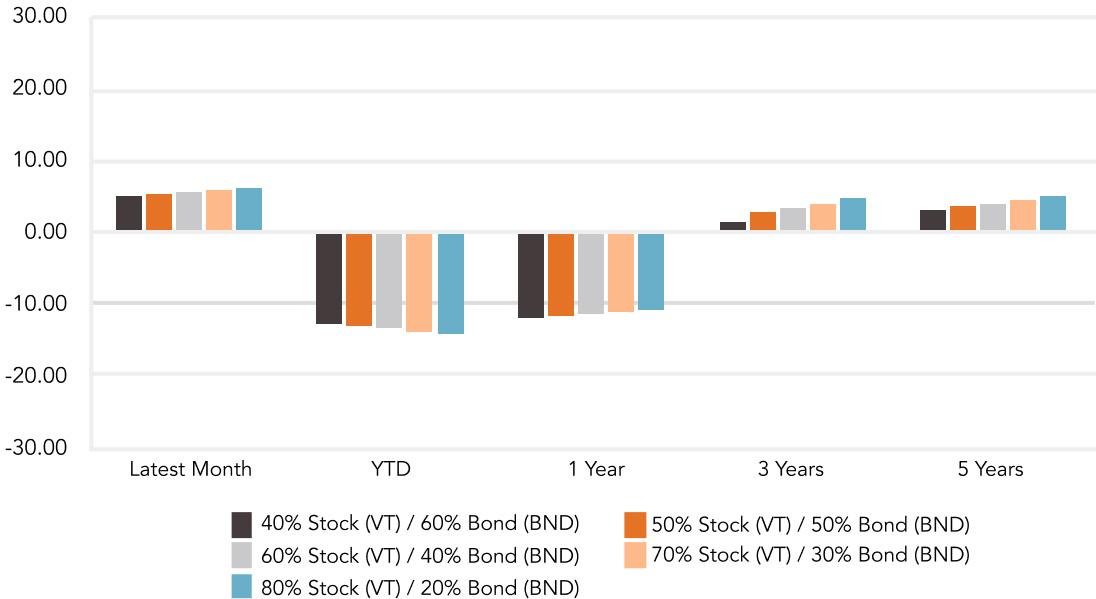

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

What You Pay For: The Percentage of Active Managers That Underperform Their Benchmarks

Trailing 10 Years Numbers As of December 31st, 2021 – S&P Spiva Scorecard

Percentage of US large-cap funds that underperformed their benchmarks

US large-cap benchmark:

S&P 500

Percentage of international funds that underperformed their benchmarks

International benchmark:

S&P International 700

Percentage of emerging market funds that underperformed their benchmarks

Emerging Markets benchmark:

S&P/IFCI Composite

The SPIVA Scorecard is a robust, widely-referenced research piece conducted and published by S&P DJI that compares actively managed funds against their appropriate benchmarks on a semiannual basis.

April 2024 Market Commentary