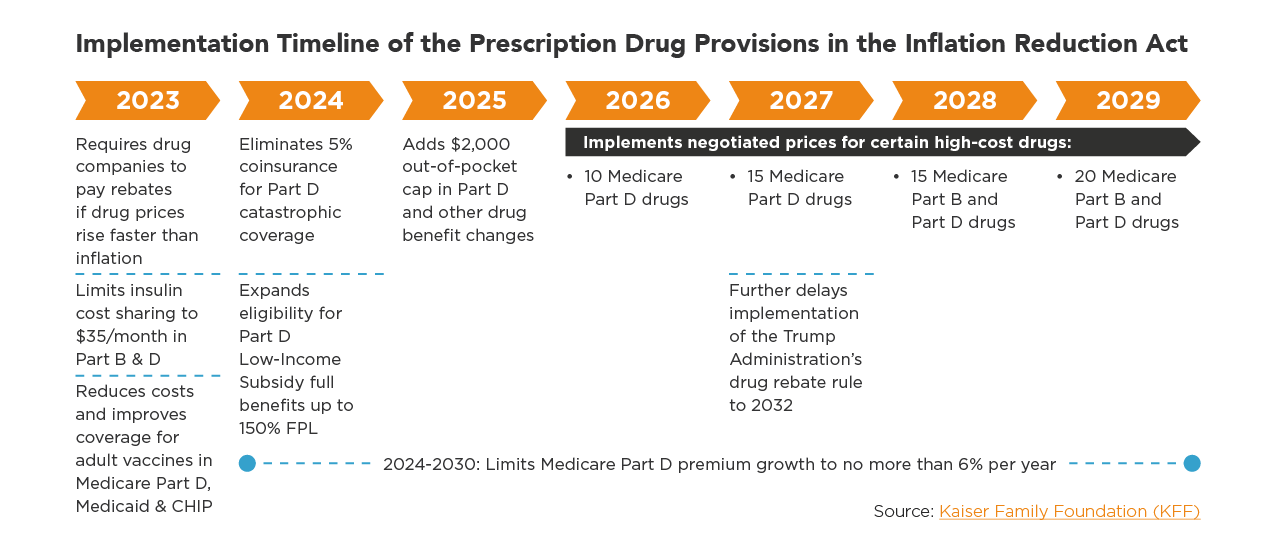

In 2022, Congress passed legislation that included lowering Medicare prescription drug costs. Some provisions took effect at the start of 2023. Others, like the $2,000 out-of-pocket cap on prescription drugs, roll out in 2025. As you plan for health care costs in retirement, consider these current and proposed drug cost changes.

What to Expect From Price Negotiations

Effective this year, the federal government will negotiate prices for certain high-cost drugs, primarily those without a generic or biosimilar equivalent. These drugs include both those covered under Part D of Medicare (retail prescription drugs) and Part B drugs (drugs administered by hospitals).

As noted in the chart, the number of negotiated drugs is limited to 10 Part D in 2026, another 15 Part D in 2027, another 15 Part B and D drugs in 2028, and another 20 Part B and D drugs in 2029 and later years.

How many Medicare beneficiaries will see lower out-of-pocket drug costs in any given year under this provision and the magnitude of savings will depend on which drugs are subject to negotiation, the number of beneficiaries who use those drugs, and the price reductions reached through negotiation.

What to Know About Drug Rebates

Beginning in 2023, drug manufacturers will have to pay rebates to Medicare if prices increase faster than inflation, and 2021 will be used as the base year for determining price changes relative to inflation.

The number of Medicare beneficiaries who may see lower out-of-pocket drug costs in any given year will depend on how many beneficiaries use drugs whose prices increase more slowly than would otherwise occur and the magnitude of price reductions relative to baseline prices.

Caps on Out-of-Pocket Spending

As previously noted, there will be a $2,000 cap on out-of-pocket spending in 2025. This cap will be especially helpful for beneficiaries who take high-priced drugs to treat health conditions such as cancer or multiple sclerosis.

For example, in 2020, among those Part D enrollees without low-income subsidies, the average annual out-of-pocket spending for the cancer drug Revlimid was $6,200 (used by 33,000 beneficiaries); $5,700 for the cancer drug Imbruvica (used by 21,000 beneficiaries); and $4,100 for the MS drug Avonex (used by 2,000 beneficiaries).1

In addition, as of January 2023, there is a $35 cap on out-of-pocket per month’s supply of each insulin product covered under Medicare, and you don’t have to pay a deductible for your insulin.2

Limits on Other Increases

The law also limits annual increases in Part D premiums from 2024 to 2030 and makes other changes to the Part D benefit design.

Talk With Your Advisor

As you estimate health care expenses in retirement, Medicare prescription drug costs, along with other costs like premiums, should be included in your cash flow plan.

If you’re already retired, some of these new benefits will help bring overall costs under control. Your advisor can meet with you to discuss how to navigate Medicare-related costs and how to figure those into your overall health care costs in retirement.

Sources:

1“How Will the Prescription Drug Provisions Affect Beneficiaries?”

2 “5 Things to Know About Medicare Insulin Costs”

This article is being provided for informational and educational purposes only. It should not be construed as an individualized recommendation or personalized advice. Please contact your financial, tax, and legal professionals for more information specific to your personal situation. The information and opinions provided have been obtained from sources deemed reliable, but we make no representation regarding the accuracy or completeness of the information.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.