Medicare, the federal health insurance program for older Americans, is available regardless of income levels. But that doesn’t mean everyone pays the same premiums. There are two areas where high-income recipients can expect to pay a bit more.

Part B Premiums

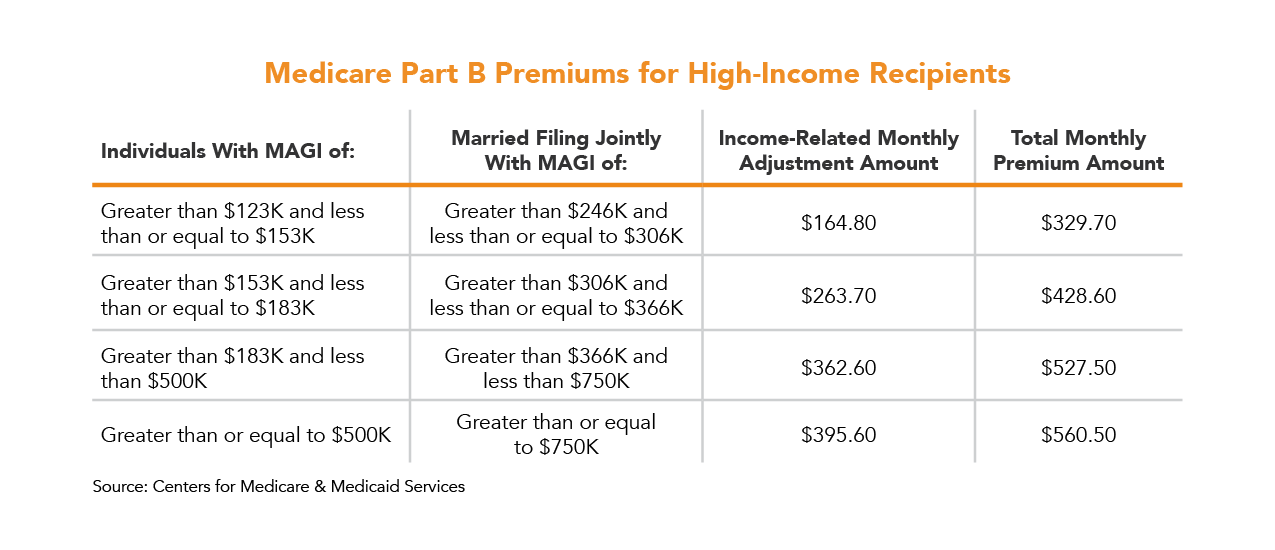

Medicare Part B, which covers doctor visits and other outpatient care, is one of two areas where what you pay is tied to your income level. Its base monthly premium as of 2023 is $164.80. But that premium rises above a certain income level. If you claimed a modified adjusted gross income (MAGI) of more than $97,000 on your individual tax return, or more than $194,000 on a joint tax return, then you will face a higher cost each month. For example, if your individual MAGI is between $183,000 and $500,000, or your joint MAGI is between $366,000 and $750,000, your monthly Part B premium would be $527.50.1

Part D Premiums

Medicare Part D’s income adjustments are not as dramatic. Base premiums vary because Part D’s prescription drug coverage is provided by private insurers, but those in the highest income tier—more than $500,000 for individuals or $750,000 for joint filers—pay an extra $76.40 in premiums per month.

Medicare in Perspective

Wealthy individuals and couples don’t face a serious burden from Medicare premiums, but it is not pleasant to be taken by surprise by the higher costs assessed. As you navigate the health care options for your retirement years, it’s worth understanding the system’s costs, including where you may pay more than the average recipient. Your wealth advisor can help with retirement health care planning, including long-term care and other costs not covered by Medicare.

This article is being provided for informational and educational purposes only. It should not be construed as an individualized recommendation or personalized advice. Please contact your financial, tax, and legal professionals for more information specific to your personal situation. The information and opinions provided have been obtained from sources deemed reliable, but we make no representation regarding the accuracy or completeness of the information.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.