Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Key Observations

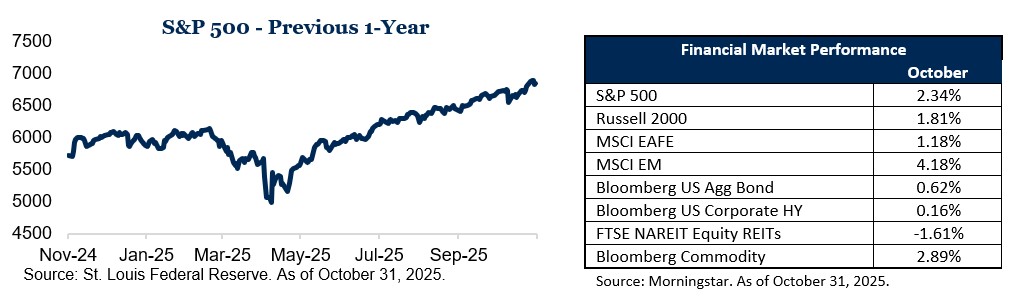

- The S&P 500 rose 2.3% in October 2025, ending the month at 6,840, while the Dow and Nasdaq also notched monthly gains as the “Magnificent Seven” big tech firms reported robust earnings. The strong close capped a best midyear performance stretch since 1950, with equities climbing despite ongoing government shutdown risks and volatile market sentiment throughout the month.

- Despite the lack of an official jobs report for October due to the prolonged government shutdown, high-frequency data—like credit card spending—suggested that consumer activity remained solid and the economy continued to “hang in there.” Survey data indicated growth in the services sector, while business confidence was dented by high tariffs and policy uncertainty, especially relating to exports.

- The MSCI EAFE Index—which tracks developed international markets—gained about 1.2%, reflecting modest positive performance amid a resilient global backdrop. Meanwhile, the MSCI Emerging Markets Index surged by 4.2% for the month, supported by improving sentiment toward select emerging economies.

As October 2025 drew to a close, financial markets and the broader economy delivered another month of noteworthy developments. For October, three main trends stand out: strong gains and new records for U.S. stocks, continued economic resilience despite government shutdown impacts and a mixed but cautiously optimistic environment in global markets.

US stocks surge to records

The U.S. stock market saw a continuation of its 2025 rally in October, with all major indices closing the month higher. The S&P 500 rose 2.3% to finish around 6,840, and the Dow and Nasdaq also posted monthly gains. Notably, the “Magnificent Seven”—the largest tech firms led by Apple, Amazon, Alphabet, Microsoft, Nvidia, Meta and Tesla—played a central role in driving returns. Strong third-quarter earnings from these giants helped lift the tech sector as well as the broader market, reinforcing investor enthusiasm for growth and innovation-oriented businesses.

October’s stock performance capped a strong stretch of mid-year gains. The market managed to climb despite considerable backdrop risks, including government shutdown threats and bouts of elevated volatility that punctuated trading sessions throughout the month. Positive sentiment from the Federal Reserve’s reaffirmed commitment to monitoring conditions closely—along with hopes for eventual interest rate cuts—gave investors additional reasons for optimism. While some profit-taking occurred after big tech earnings announcements, buyers continued to step in amid dips, bolstering the overall upward trend.

Economic resilience amid shutdown and data gaps

While the stock market posted robust returns, the U.S. economy managed to “hang in there” during October, despite challenges related to a prolonged federal government shutdown. The shutdown led to a gap in official economic reporting, notably the absence of the usual monthly jobs report. However, alternative data—such as high-frequency credit card spending—helped approximate the shape of ongoing economic activity. This alternative data pointed to continued solid consumer spending, which has long been a staple of American economic strength.

On the business side, the services sector registered ongoing growth, supporting overall economic momentum. However, persistent trade tariffs and uncertainty around policy directions—exacerbated by the shutdown and legislative standoffs—dampened business confidence, especially for industries heavily reliant on exports. Even as factory activity and manufacturing exports remained challenged, the domestic-oriented sectors showed resilience, with households maintaining reasonable levels of consumption.

Several observers highlighted that while headline economic growth was positive “under the surface,” uncertainty persisted. Questions related to when the shutdown would end, what impact lagging public-sector activity might have on future reports and the possible consequences of delayed government payments added complexity to the outlook. Nevertheless, the enduring strength of the services sector and the steady hand of the consumer continued to provide ballast, mitigating the more negative effects directly tied to the shutdown.

Global markets results

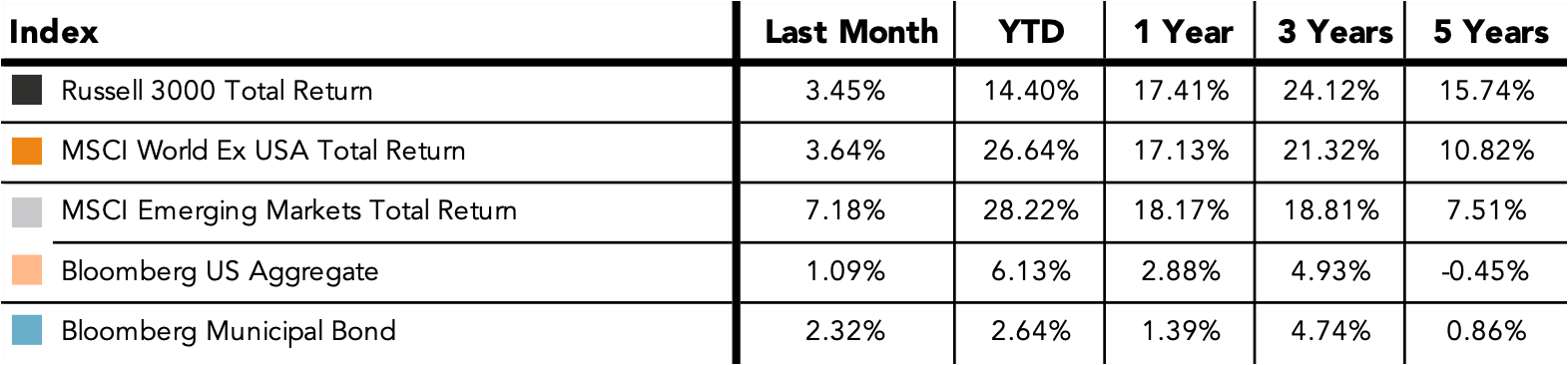

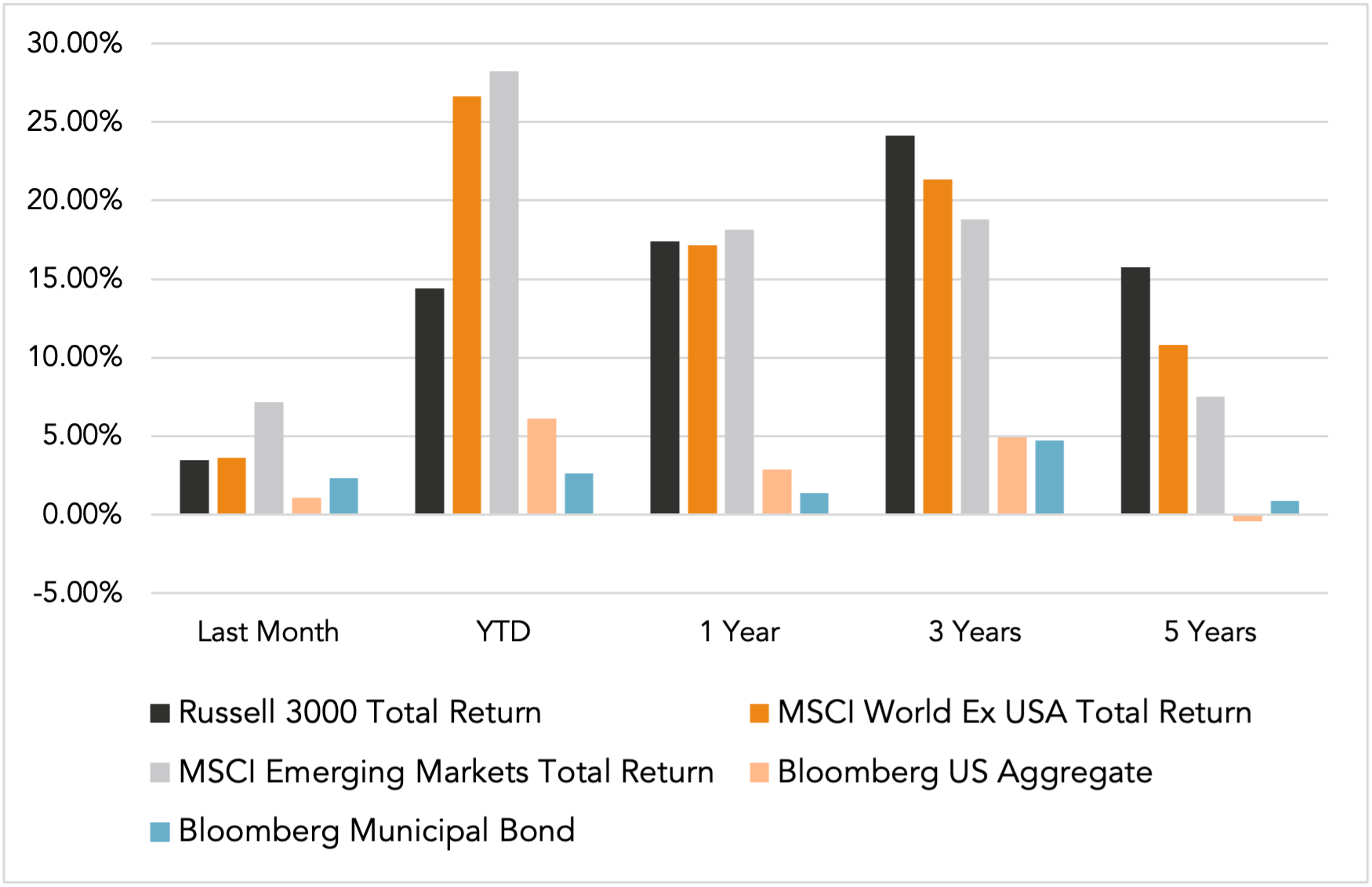

Outside the United States, international equity markets produced positive, but more moderate, returns compared to U.S. stocks in October. The MSCI EAFE Index, which represents developed international markets, gained approximately 1.2% for the month, reflecting a mix of resilient large-cap performance in regions such as Europe and Japan. Meanwhile, the MSCI Emerging Markets Index delivered a notably strong month, surging by 4.2%.

The sharp outperformance in emerging markets during October was highlighted by improved sentiment toward commodity exporters and a renewed outlook for growth in select Asian and Latin American economies. Despite cautious underlying sentiment in some developed regions due to macroeconomic uncertainties, the broad-based gains across both the MSCI EAFE and EM indexes underscored the benefits of global diversification within long-term portfolios. October’s performance continues the 2025 trend of strong international performance. Year-to-date, the MSCI EAFE is up 27%, while emerging markets stocks are up over 33%, outpacing most U.S. indexes.

Closing Thoughts

In summary, October delivered a powerful leg higher for U.S. equities, driven by strong technology earnings and momentum that defied persistent headline risks. Economic activity weathered the government shutdown thanks to the strength of consumers and the services sector, though data gaps and policy concerns merit continued monitoring.

Thank you for your continued trust.

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through October 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes referenced are unmanaged and cannot be directly invested into. For index definitions visit https://www.marinerwealthadvisors.com/index-definitions/

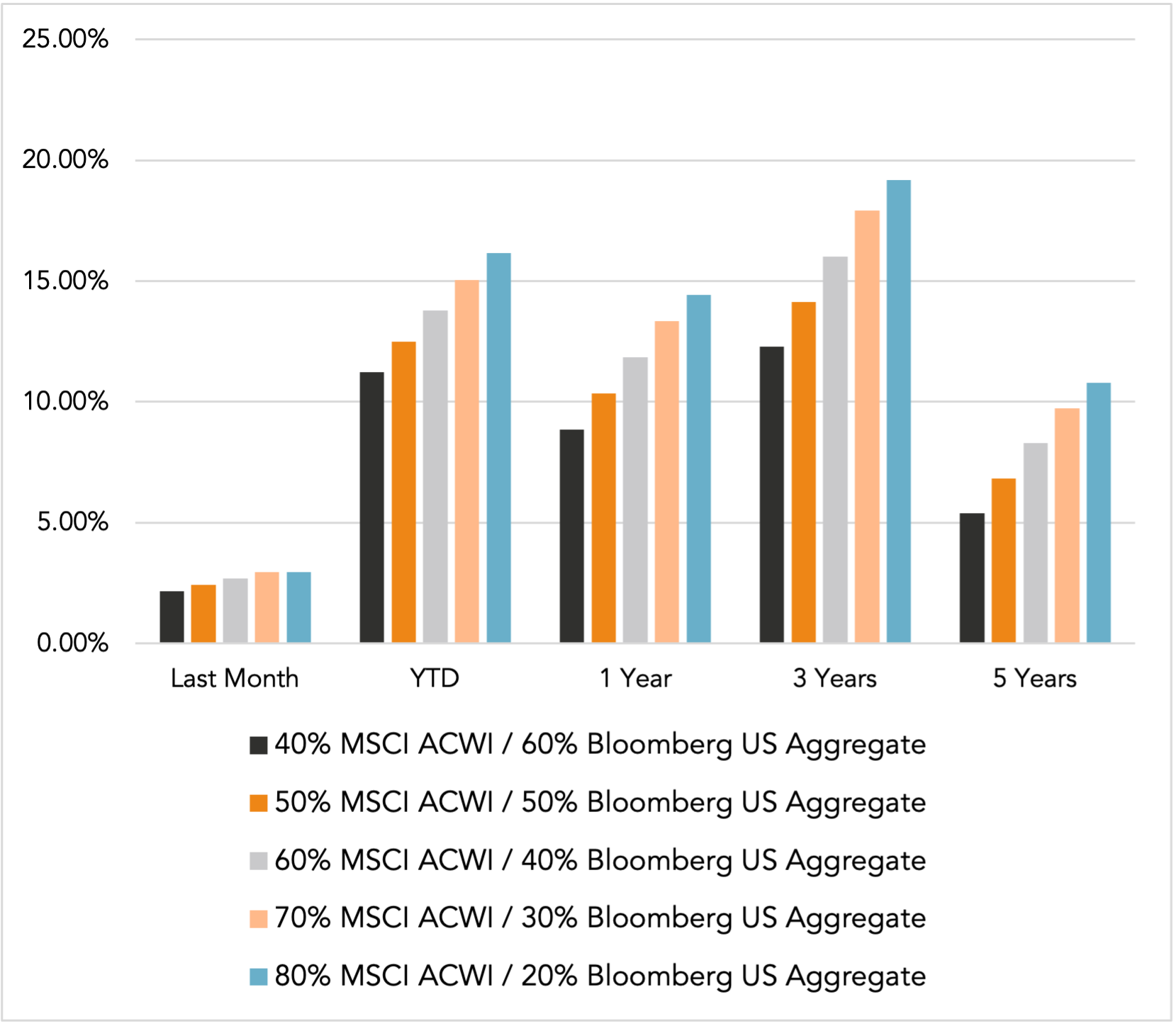

Does past performance matter?

Major Market Index Returns

Period Ending 10/1/2025

Multi-year returns are annualized.

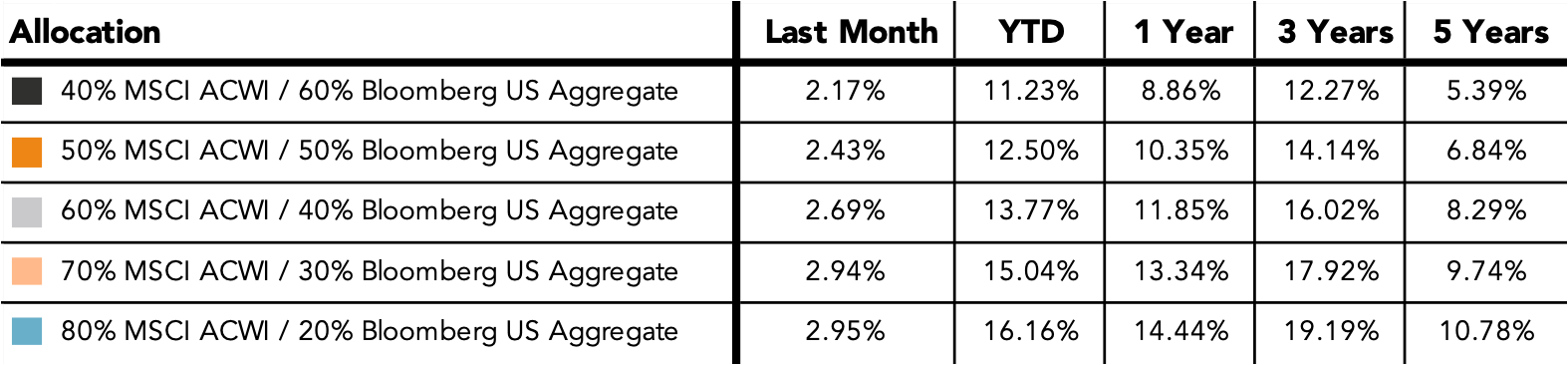

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – January 2026