Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Key Observations

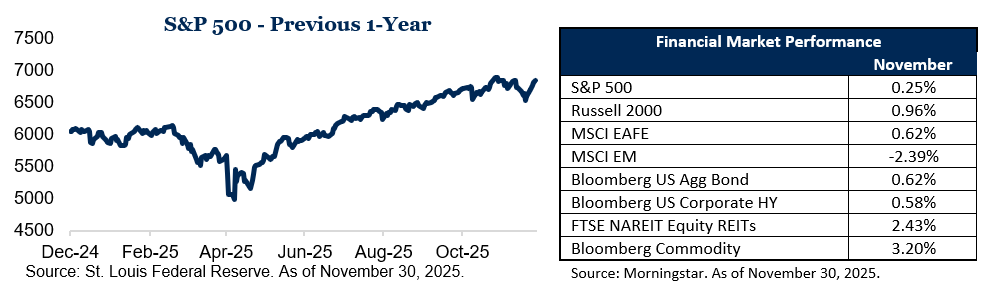

- Developed‑market equities were roughly flat to modestly positive in November, with major indices posting only small gains for the month. Day‑to‑day moves were choppy, driven by shifting expectations around interest rates, inflation and growth.

- Mega‑cap growth and tech stocks generally lagged, while value‑oriented and smaller‑cap companies tended to perform better. Market leadership broadened beyond a narrow group of large technology names as equal‑weighted and value‑tilted benchmarks outpaced cap‑weighted indices.

- Long‑term bond yields eased over the month, supporting fixed‑income returns and reflecting increased confidence that inflation is moderating. Disinflation signals and economic data led markets to price in a higher likelihood of central bank rate cuts in the coming quarters.

November 2025 may not have looked especially eventful if you focused only on the headline index returns, but the month featured plenty of meaningful shifts under the surface. The commentary that follows builds on the key observations above, taking a closer look at how those market moves unfolded and what they meant across equities and fixed income.

Equities: Quiet finishes, volatile paths

Across major developed markets, broad equity indices ended November roughly flat to mildly positive for the month, with the S&P 500 and other large benchmarks posting only small gains. That relatively subdued monthly outcome masked a choppy trading environment, as several commentaries noted that heightened day‑to‑day price swings contrasted with the modest moves seen in month‑end index levels.

Intraday and intraweek swings were driven by changing expectations around the Federal Reserve’s policy path, markets’ response to the temporary U.S. government shutdown and subsequent reopening, and ongoing debate about whether elevated valuations in artificial‑intelligence (AI)-linked and other mega‑cap technology names were still justified. As a result, even though the month‑end snapshots of the indices looked uneventful, the journey through November reflected a market continually reassessing risk, growth and interest‑rate assumptions.

Leadership rotation: Beyond mega‑cap growth

Beneath the calm surface of the major benchmarks, leadership within the equity market continued to evolve, with several November recaps pointing to a shift away from the narrow group of mega‑cap growth and AI‑linked technology stocks that had previously dominated returns. Large‑cap growth and mega‑cap technology generally lagged the broader market over the month as profit‑taking, valuation concerns and reassessment of AI‑related earnings expectations weighed on these segments.

By contrast, value‑oriented stocks and smaller‑capitalization names generally fared better in November, with multiple sources highlighting stronger results in mid‑caps, small‑caps and more cyclically oriented sectors. Equal‑weighted versions of major benchmarks and value‑tilted indices outpaced traditional cap‑weighted, tech‑heavy measures, indicating that performance was more broadly distributed than in periods dominated by a concentrated set of large technology and growth companies. This broadening of leadership suggests that investors are increasingly looking beyond a handful of mega‑cap names and are willing to re‑engage with segments that had previously lagged, such as cyclicals, financials and select industrials.

For diversified equity portfolios, this shift in leadership is notable because it illustrates how different styles—growth versus value, large cap versus small cap—can move in and out of favor over time, even when overall index levels do not change dramatically. November’s pattern highlighted the importance of what’s happening within the index, not just the headline return number investors see at month‑end.

Fixed income: Lower yields and rising rate‑cut expectations

In fixed income markets, November was generally supportive for bond investors, as long‑term government bond yields drifted lower over the course of the month. The decline in key sovereign yields, including the U.S. 10‑year Treasury benchmark, helped bond prices and improved total returns for many high‑quality fixed‑income segments.

This move in yields reflected growing confidence that inflation is continuing on a moderating, or disinflationary, path, with cooling price pressures cited in several November fixed‑income and macro commentaries. At the same time, derivatives markets and strategist surveys increasingly pointed to expectations that the Federal Reserve would deliver further policy easing after the October rate cut, with attention focused on the mid‑December meeting and the broader 2026 rate path. While the precise timing and pace of any additional cuts remain dependent on incoming data, November’s bond market behavior signaled that investors see the next major move in policy as further easing rather than renewed tightening.

These developments had several implications for the broader environment. Lower long‑term yields eased some pressure on interest‑sensitive areas of the economy, and improved financing conditions at the margin for both households and businesses. The combination of moderating inflation indicators and declining yields also improved the risk‑return profile for high‑quality bonds relative to earlier stages of the tightening cycle, when yields were rising and prices falling.

Putting November in context

Taken together, November 2025 can be seen as a transitional month in which markets moved from a narrow, mega‑cap‑led pattern of returns toward a more broadly shared leadership backdrop, while simultaneously adjusting to a changing interest‑rate outlook. On the surface, equities did little, with broad indices recording only modest gains despite notable swings; underneath the market appeared to be rebalancing its preferences and positioning ahead of potential policy shifts. In fixed income, the drift lower in yields and growing conviction around disinflation and future rate cuts framed November’s narrative as one of gradual transition from a highly restrictive stance toward a more supportive policy environment.

November’s developments underscored how quickly market narratives can evolve, even when headline returns appear muted. Thank you for your continued trust, and please reach out to your advisory team with any questions.

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through November 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes referenced are unmanaged and cannot be directly invested into. For index definitions visit https://www.marinerwealthadvisors.com/index-definitions/

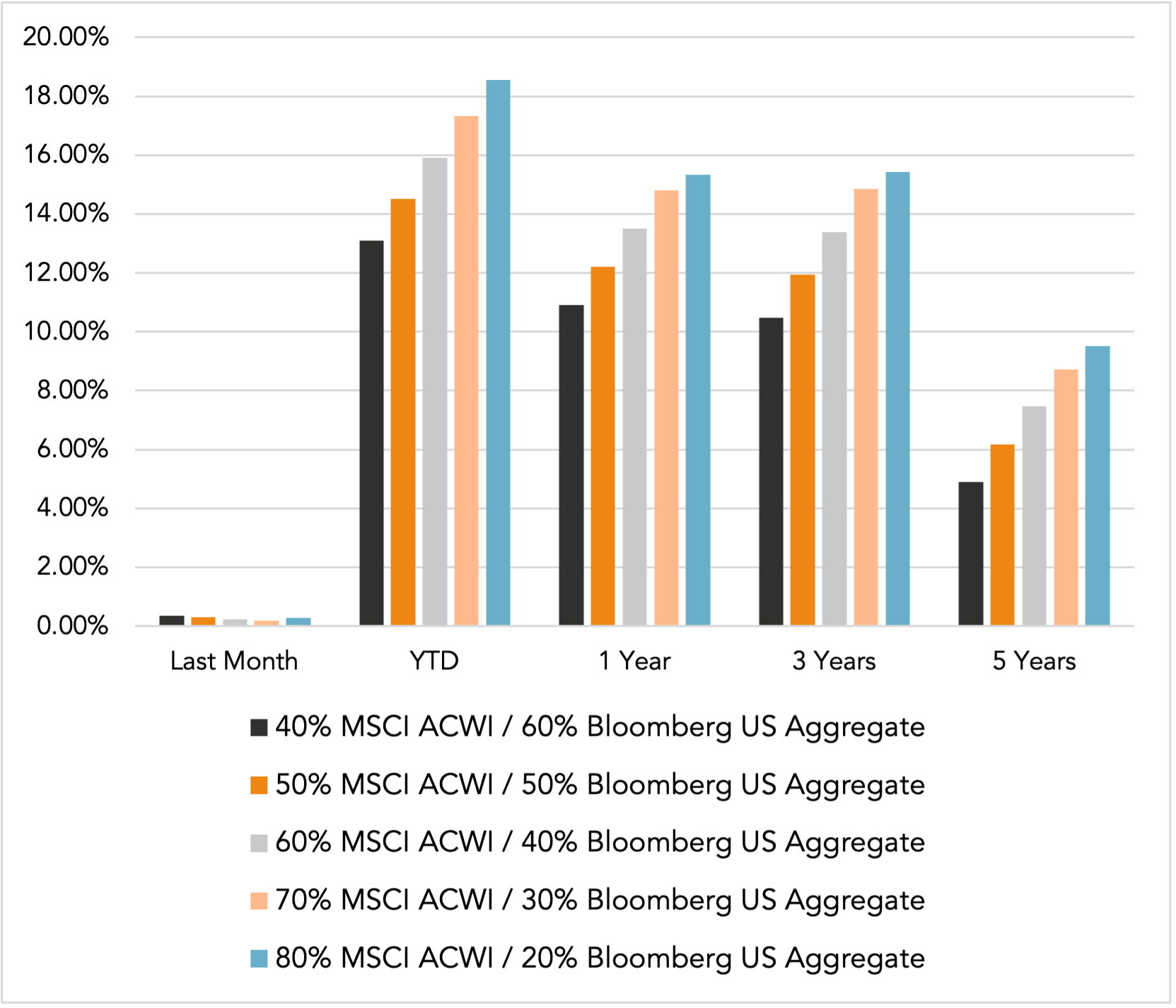

Does past performance matter?

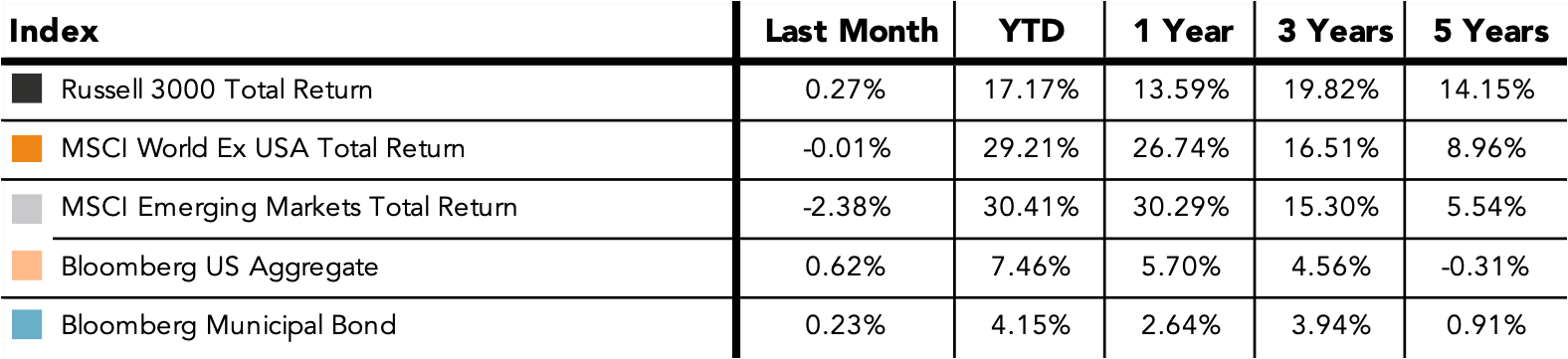

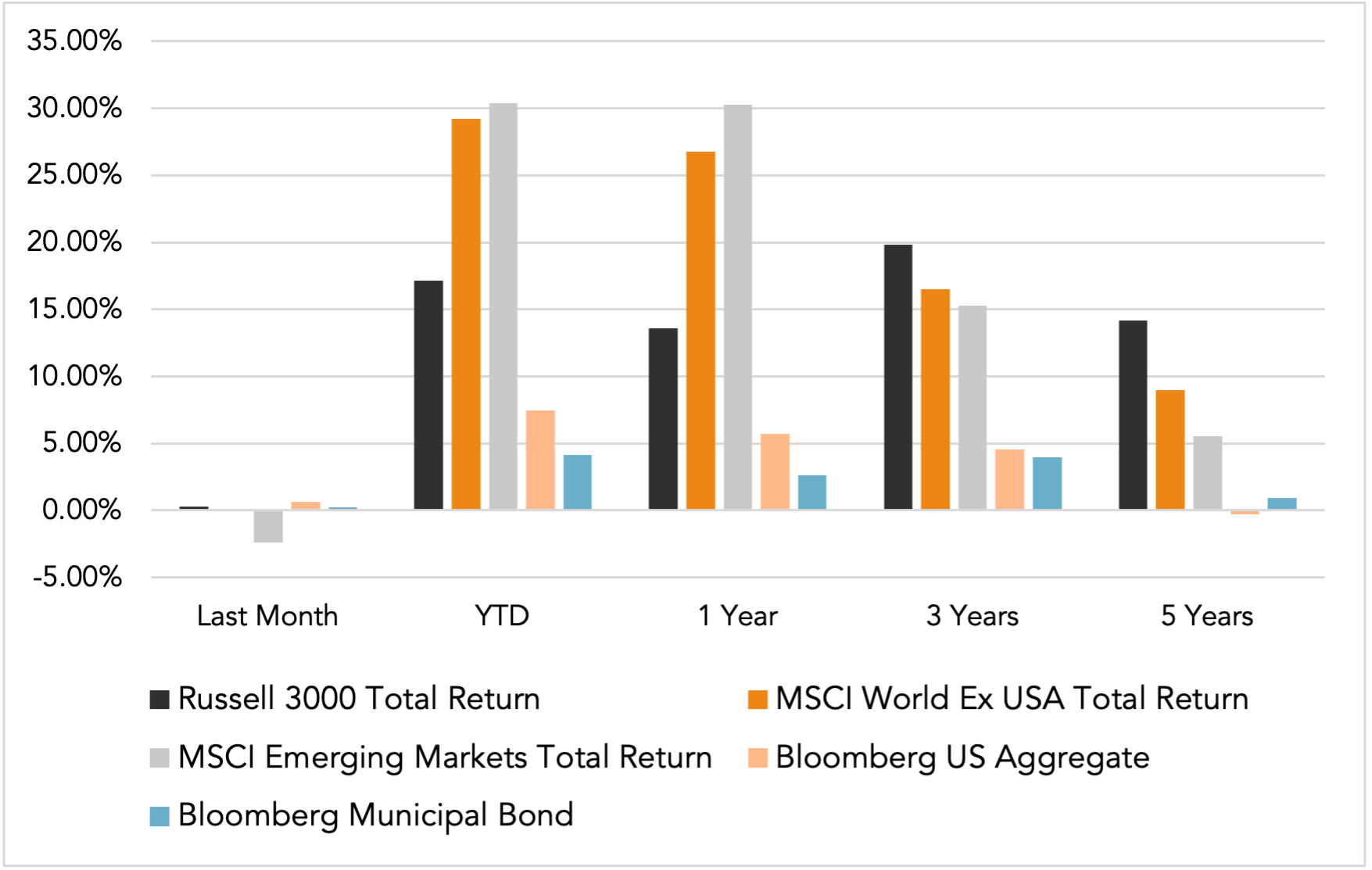

Major Market Index Returns

Period Ending 11/1/2025

Multi-year returns are annualized.

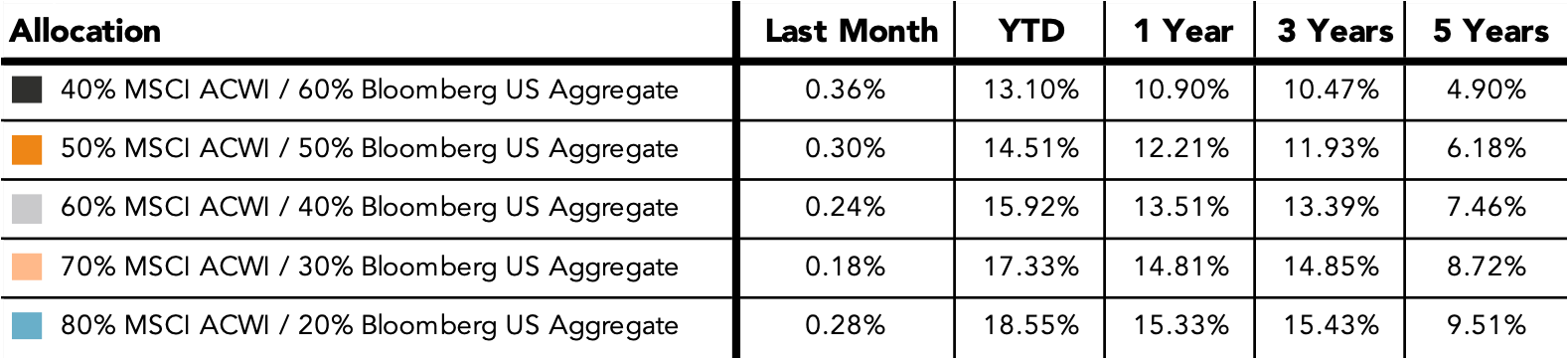

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – January 2026