Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Market Update: September 2025 In Review

Key Observations

- Private payrolls declined by about 32,000 in September, according to ADP, the first outright monthly loss since 2022. Markets increased the implied odds of another Fed rate cut at the October meeting, following the softer data.

- U.S. manufacturing remained below the 50 expansion threshold in September (ISM 49.1), while inflation readings hovered near 3% YoY. Consumer confidence eased to 94.2, the lowest since April.

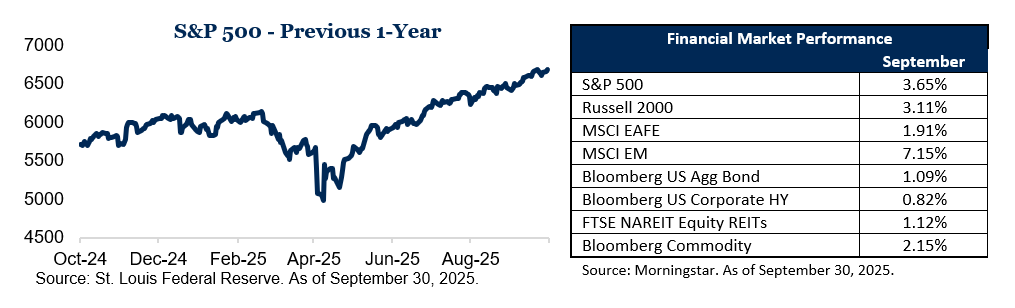

- The S&P 500 and Nasdaq set or approached record levels during September amid expectations of easier policy, while small caps joined the advance. Valuation commentary emphasized that prices are elevated, suggesting future earnings and data will be key tests for the rally.

Market Recap

A Measured Backdrop as Q4 Begins

Markets and the economy delivered mixed signals in September. Labor market data pointed to slower momentum, with ADP reporting a net job loss, while surveys of manufacturers continued to show contraction. Inflation indicators remained sticky near 3%, above the Federal Reserve’s target, but equity markets looked through the softer data and reached new highs on expectations of monetary easing.

Another development affecting interpretation of data was the federal government shutdown, which began at the end of the month and temporarily halted several key releases from agencies such as the Bureau of Labor Statistics and the Census Bureau. This interruption means that private reports, such as ADP’s payroll survey and ISM’s purchasing manager indexes, are carrying more weight than usual.

Labor Market Softens—Odds of Additional Policy Easing Firm

September’s ADP report showed a decline of 32,000 private-sector jobs, marking the first net loss since 2022. The details suggest that small and midsize companies cut positions, while larger employers managed modest hiring. Wage growth also slowed, easing cost pressures but pointing to softer household income gains.

The labor market had already been showing signs of cooling, with the official unemployment rate ticking up to 4.3% in August—its highest since 2021. The September ADP data reinforced that trend, though analysts caution that ADP and BLS reports often diverge and a fuller picture will be delayed due to the shutdown.

Markets responded quickly. CME FedWatch data indicated that futures priced in a 95–99% chance of a 25-basis-point rate cut at the October Fed meeting, reflecting a shift in sentiment toward faster easing. Treasury yields edged lower during the month, and interest-sensitive sectors such as real estate and utilities saw gains on expectations of cheaper financing.

Production, Prices and Sentiment Point to a Gradual Cooling

On the production side, the ISM Manufacturing PMI rose to 49.1 in September, a slight improvement from August’s 48.7, but still below the 50 mark separating expansion from contraction. This was the seventh consecutive month in contractionary territory, with companies citing weak orders and cautious capital spending.

Inflation data showed headline CPI rising 2.9% YoY in August and core CPI at 3.1%, little changed from July. That steadiness is both a reassurance—no re-acceleration—and a concern, as it leaves inflation above the Fed’s 2% goal.

Households grew more cautious. The Conference Board’s consumer confidence index fell to 94.2 in September, its lowest reading since April; respondents noted fewer perceived job opportunities and a dimmer outlook for big-ticket purchases. The divergence between still-resilient economic activity in some sectors and the softer sentiment data illustrates the uneven nature of this phase of the cycle.

Equities Advanced on Policy Hopes, with Broader Participation

Despite the economic crosscurrents, U.S. equities delivered strong gains in September. The S&P 500 and Nasdaq set new records, while the Dow also posted solid advances. Importantly, market breadth improved: the Russell 2000 small-cap index closed at an all-time high for the first time since 2021, showing that leadership extended beyond mega-cap technology stocks.

Globally, developed international markets rose modestly in September, supported by lower energy prices and early signs of stabilization in Europe. Emerging markets were more mixed, with currency pressures and uneven growth in China offsetting gains elsewhere.

Conclusion

September combined evidence of a softening labor market, continued contraction in manufacturing and inflation readings near 3%, with equity markets that advanced strongly on policy expectations. The result is an investment environment where economic data signal moderation, while financial markets remain supported by anticipated central bank easing and broadening participation.

With some official reports delayed by the government shutdown, investors will be closely watching upcoming inflation and jobs releases when they resume, along with the October Fed meeting. These will help clarify whether September’s themes of slower hiring, sticky prices and resilient markets continue into the fourth quarter. As always, thank you for your trust.

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through August 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes referenced are unmanaged and cannot be directly invested into. For index definitions visit https://www.marinerwealthadvisors.com/index-definitions/

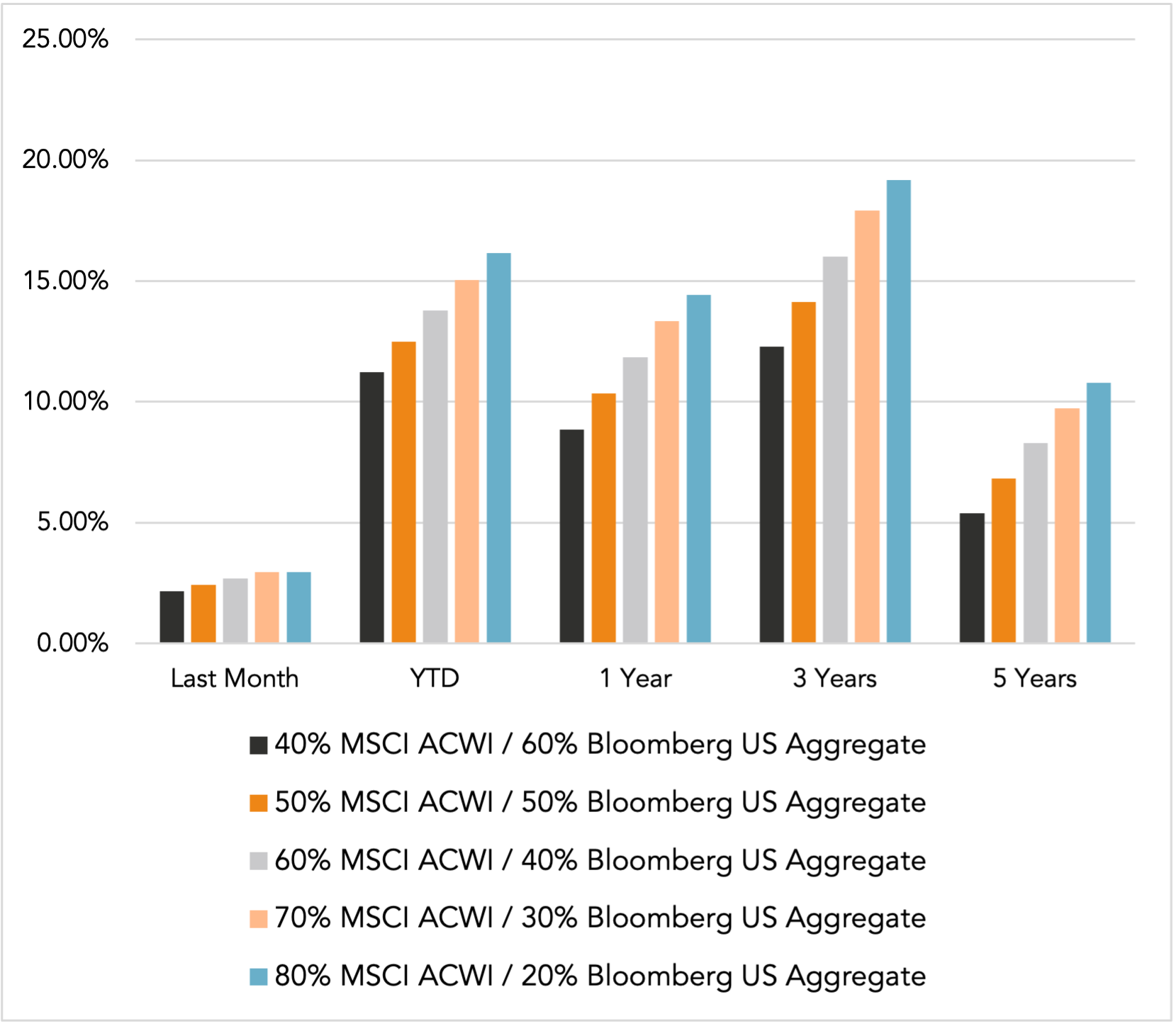

Does past performance matter?

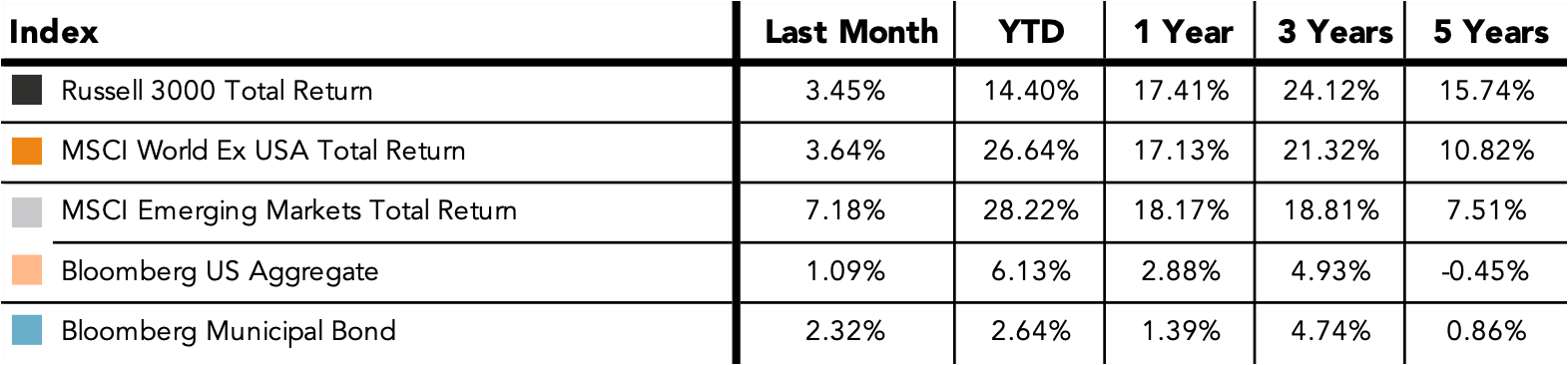

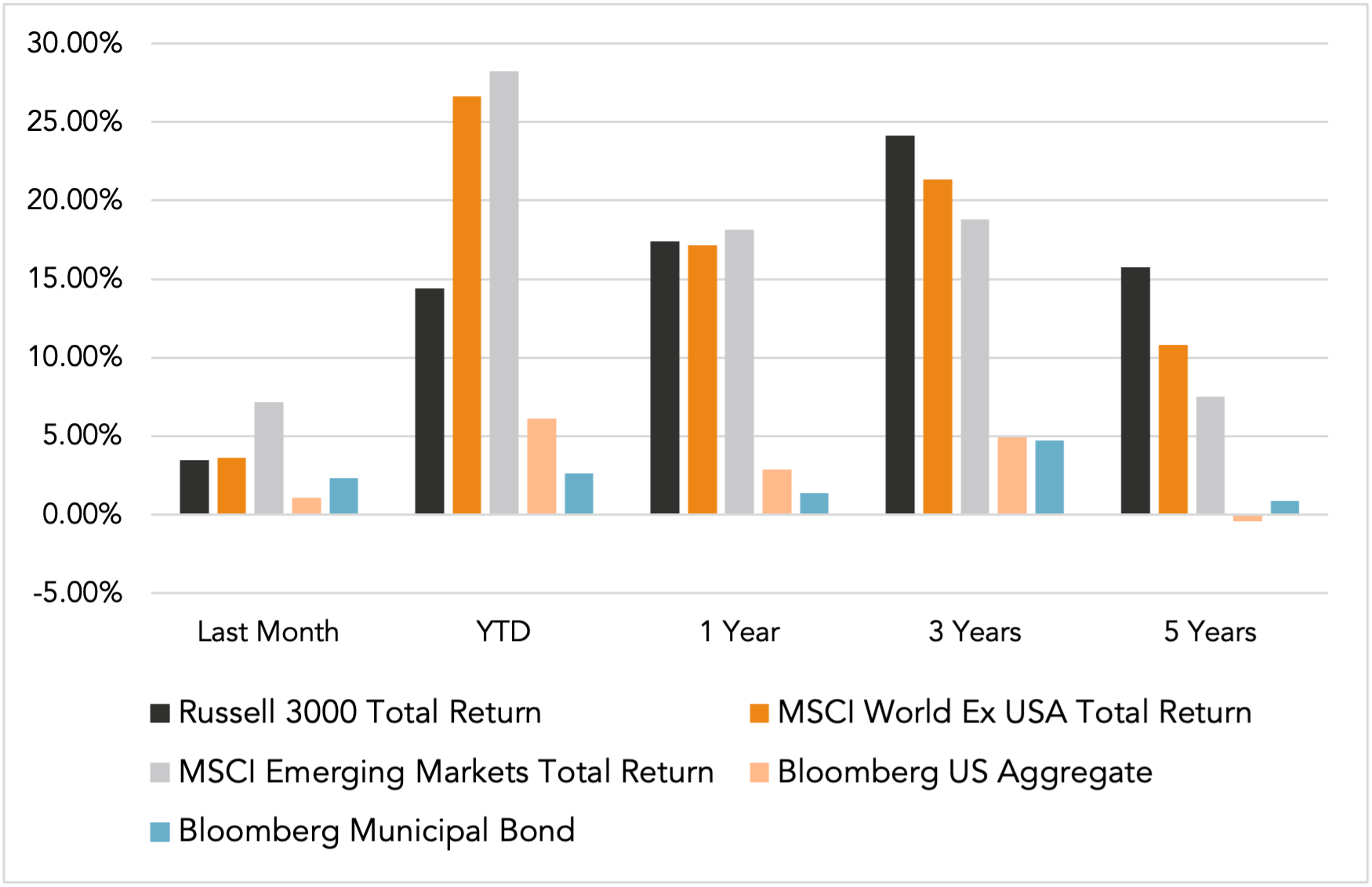

Major Market Index Returns

Period Ending 10/1/2025

Multi-year returns are annualized.

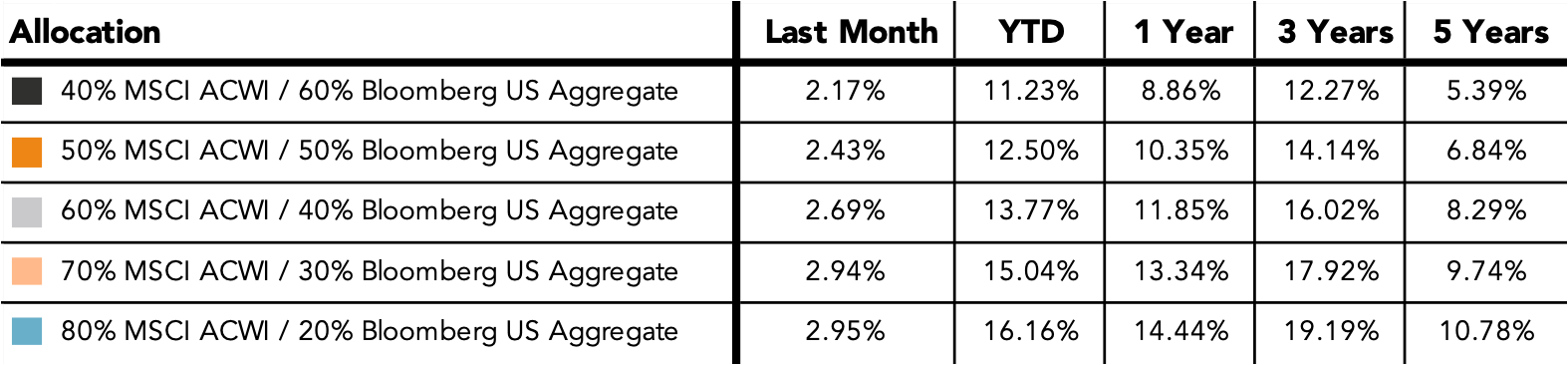

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – October 2025