Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Market Update: May 2025 In Review

Key Observations

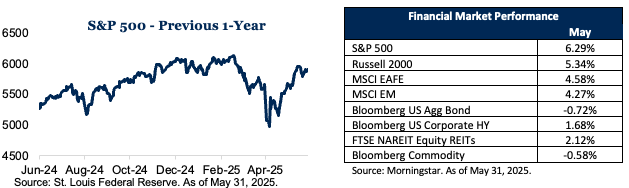

- U.S. stock markets posted their strongest monthly gains since late 2023, with the S&P 500 and Nasdaq surging on strong tech earnings and improved inflation data. The rally, which was supported by easing trade tensions, broke a three-month losing streak.

- Despite the market rebound, U.S. GDP contracted in the first quarter as businesses rushed imports ahead of new tariffs. Growth forecasts for 2025 have been cut, with trade policy and fiscal uncertainty weighing on the outlook.

- International equities—especially in Europe and emerging markets—have delivered double-digit gains in 2025, far outpacing the S&P 500’s modest increase. This marks a significant shift in market leadership, driven by monetary easing and sector rotation abroad.

As we close the books on May 2025, we’re pleased to provide you with our monthly market update. This month was marked by a notable rebound in U.S. equities, ongoing economic crosscurrents, and the continued outperformance of international stocks. Below, we outline three key observations shaping the investment landscape as we approach the midyear mark.

Market Recap

U.S. Stock Markets Rebound Sharply in May

After a challenging start to the year, U.S. equity markets staged their strongest monthly rally since late 2023. The S&P 500 and Nasdaq Composite led the charge, buoyed by robust earnings from leading technology firms and signs that inflationary pressures may be easing. This surge broke a three-month losing streak for major indexes, with the technology sector providing much of the momentum. Investors responded positively to a combination of better-than-expected corporate results, a temporary pause in new tariffs, and a sense that the Federal Reserve may be nearing the end of its rate-hiking cycle.

Market sentiment was also helped by a brief easing in U.S.-China trade tensions, which had weighed heavily on risk assets earlier in the year. The rally was broad-based, with the Dow Jones Industrial Average and the Russell 2000 also posting solid gains. However, it’s worth noting that much of the market’s strength was concentrated in large-cap technology names, while other sectors and smaller companies have lagged somewhat behind.

Despite this impressive rebound, the S&P 500 remains only marginally higher for the year, reflecting the volatility and uncertainty that have characterized markets in 2025. The sharp selloff in April, triggered by renewed trade concerns and a spike in bond yields, underscored just how sensitive investors remain to macroeconomic and policy developments. Nevertheless, May’s performance provided a welcome respite and demonstrated the market’s capacity to recover swiftly when sentiment improves.

Economic Growth Slows Amid Tariffs and Trade Uncertainty

Beneath the surface of the equity rally, the U.S. economy continues to grapple with significant headwinds. Real GDP contracted in the first quarter of 2025, primarily due to a surge in imports as businesses rushed to get ahead of newly announced tariffs. This front-loading of economic activity has distorted underlying growth trends and created a challenging environment for policymakers and investors alike.

Looking ahead, most economists have revised down their forecasts for U.S. growth in 2025, with consensus expectations now centered around 1.5% or lower for the year. The imposition and partial rollback of tariffs have created volatility and uncertainty, complicating business planning and investment decisions. While consumer spending remains resilient, business investment has slowed, and manufacturing activity has softened in response to the uncertain trade environment.

Fiscal pressures are also mounting. The national debt continues to rise, and a recent credit rating downgrade cited unsustainable debt projections as a concern. Inflation, while moderating somewhat in recent months, remains above the Federal Reserve’s target; the central bank has signaled it will keep interest rates steady for the time being. These factors, combined with ongoing trade negotiations and policy uncertainty, are likely to keep both inflation and interest rates elevated in the near term.

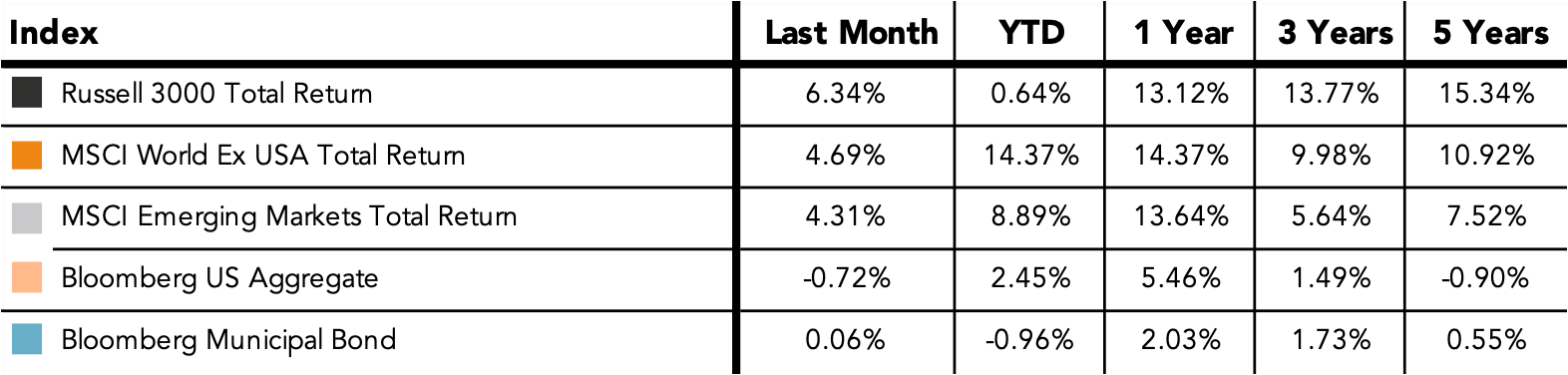

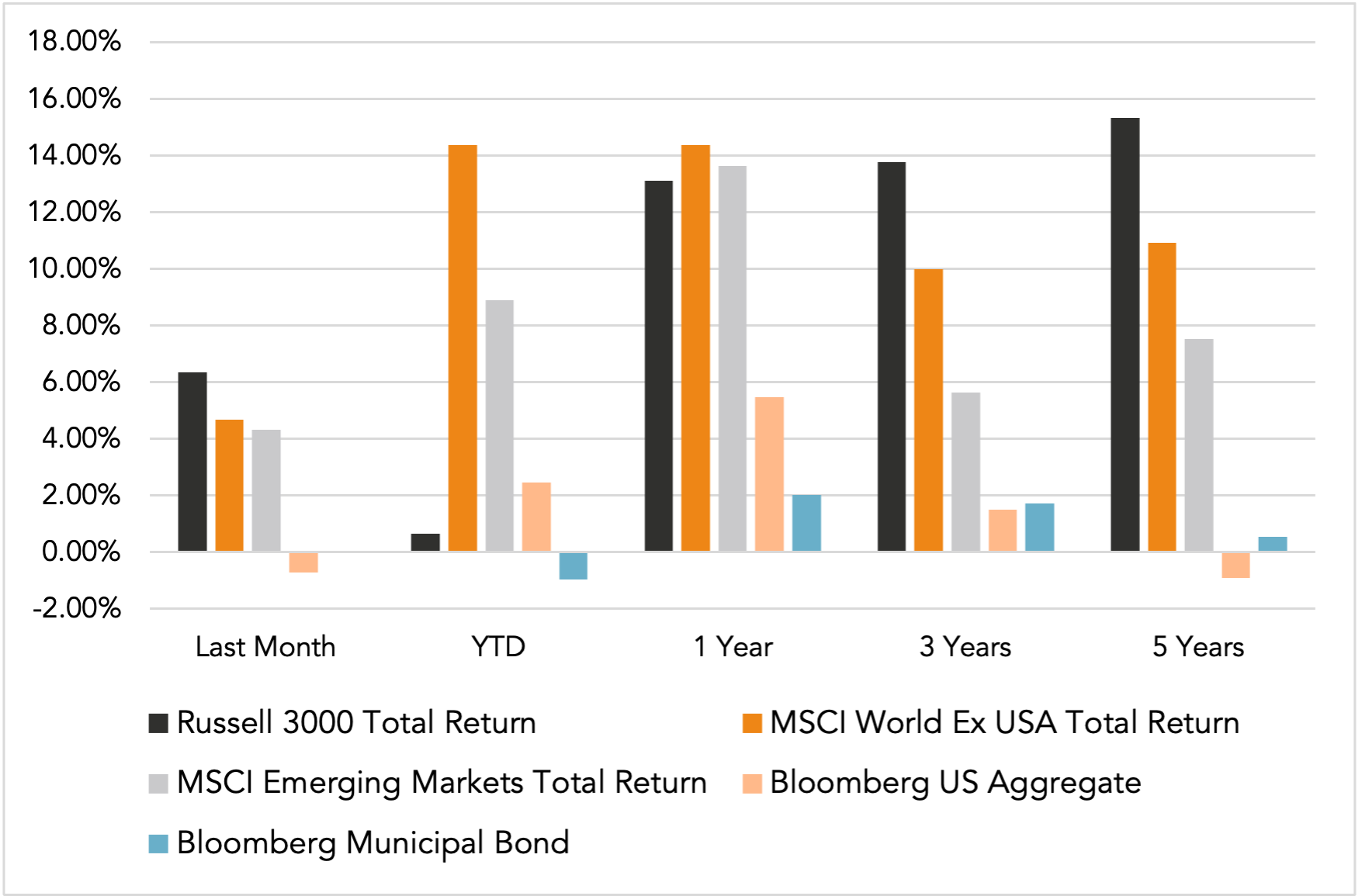

International Stocks Continue to Outperform U.S. Equities Year-to-Date

Perhaps the most striking development of 2025 so far has been the decisive outperformance of international equities relative to their U.S. counterparts. The broad European market-focused Stoxx 600 Index has outpaced the S&P 500 by over 20 percentage points in dollar terms, a reversal of the long-standing trend of U.S. market dominance.

Several factors are driving this shift. Europe’s economic outlook has brightened thanks to significant fiscal stimulus, a robust euro, and a rebound in industrial activity. The European Central Bank’s recent rate cuts have provided additional support, while increased defense spending and improved corporate earnings have further bolstered investor confidence. Emerging markets, particularly in Eastern Europe and Latin America, have also benefited from more attractive valuations and improving macroeconomic conditions.

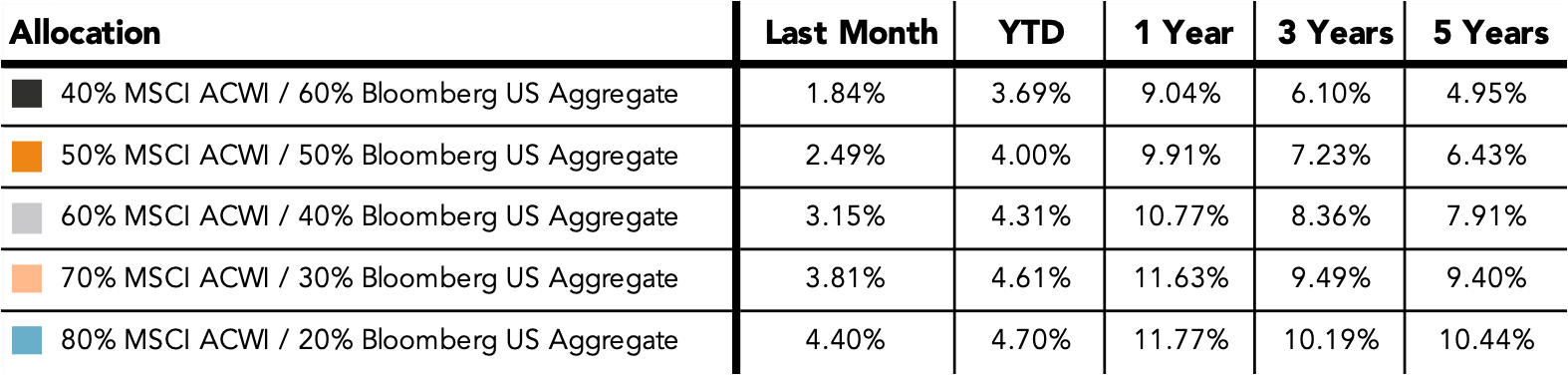

In contrast, U.S. equities have struggled to gain traction, with the S&P 500 up only 1.1% year-to-date. The shift in performance has benefitted global diversification strategies, with many investors seeking to capitalize on the relative strength of international markets. While some analysts caution that U.S. markets still offer structural advantages—such as liquidity and innovation—and we maintain our U.S. tilt, the current environment has clearly favored overseas equities.

This trend marks a significant change from the past decade, during which U.S. stocks consistently outperformed most global peers. The “U.S. exceptionalism” narrative that dominated investor thinking at the start of the year has given way to a more balanced view, with global diversification once again in focus.

Closing Thoughts

May 2025 was a month of contrasts: a strong rebound in U.S. equities, ongoing economic headwinds at home, and a remarkable run for international stocks. These developments underscore the importance of maintaining a broad perspective and staying attuned to shifts in the global investment landscape.

As always, we remain committed to monitoring market conditions closely and we’ll continue to keep you informed of significant trends and developments. Thank you for your trust.

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through May 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes are unmanaged and cannot be directly invested into. Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification. The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. The Dow Jones Industrial Average is a stock market index of 30 prominent companies listed on stock exchanges in the United States

Does past performance matter?

Major Market Index Returns

Period Ending 6/1/2025

Multi-year returns are annualized.

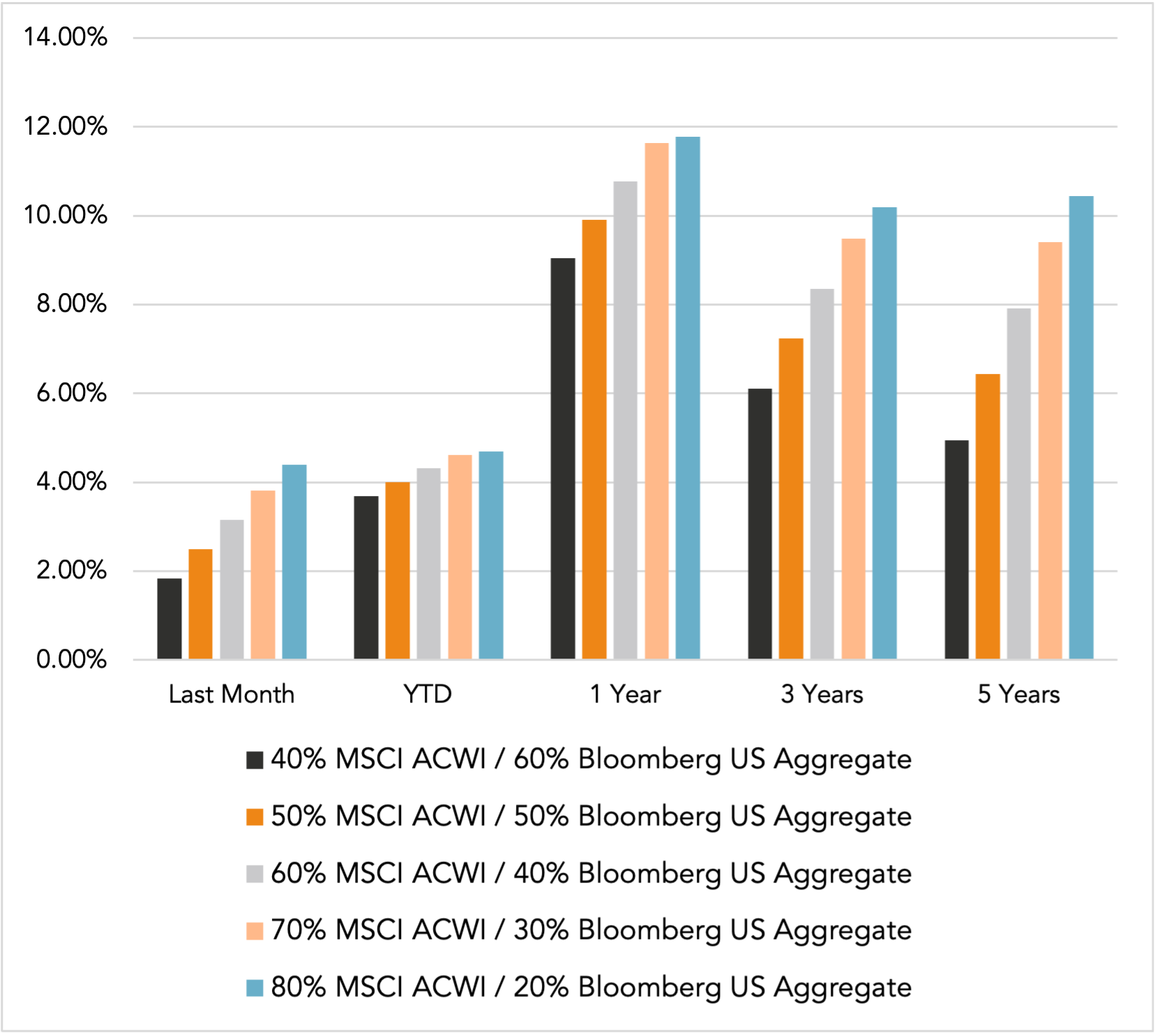

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – January 2026