Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Market Update: June 2025 In Review

Key Observations

- U.S. stock markets reached record highs in June 2025, rebounding after earlier tariff-driven volatility. Tech and AI stocks led the rally as trade tensions eased and investor sentiment improved.

- Economic growth is slowing, with U.S. GDP projected to drop to around 1.6% in 2025. Higher tariffs and weaker consumer demand are expected to further dampen business investment and hiring.

- Inflation remains stubbornly high while the labor market shows signs of weakening. The Federal Reserve is holding rates steady, waiting for clearer signs of inflation moderation despite rising unemployment.

As the second quarter and June 2025 come to a close, we are pleased to provide you with an update on the latest developments in the financial markets and the broader economic landscape. This month has been marked by notable milestones in equity markets, evolving economic signals and ongoing policy challenges. The following update summarizes the key trends and data points that shaped the investment environment in June.

Market Recap

Stock Markets Reach New Highs Amid Receding Volatility

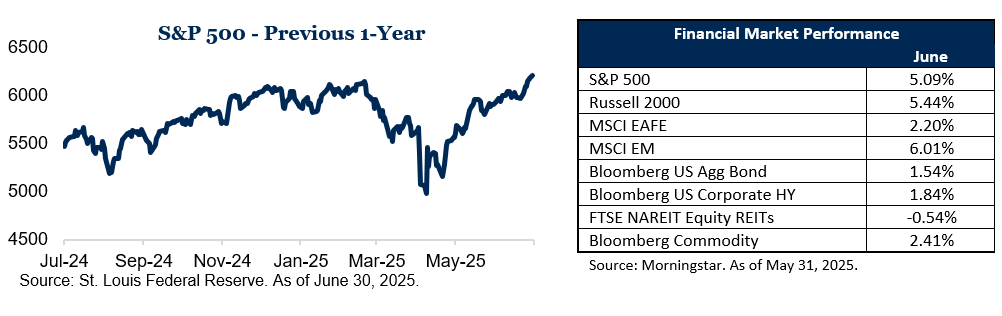

June saw a remarkable resurgence in U.S. equity markets, with major indices not only recovering from earlier-year setbacks but also establishing new all-time highs. The S&P 500 advanced approximately 5.1% for the month, while the Nasdaq Composite surged by over 6.3%. This rally followed a period of pronounced volatility earlier in 2025, which had been triggered by escalating tariff measures and heightened uncertainty around global trade policy.

The rebound was driven in large part by optimism over a de-escalation in trade tensions. Key tariff threats that had weighed on investor sentiment were paused or partially rolled back, providing a measure of relief to markets. Technology and artificial intelligence (AI) sectors were at the forefront of the advance, reflecting both strong earnings reports and continued enthusiasm for innovation-driven growth. As a result, volatility measures declined, and investor confidence improved notably as the month progressed.

While the market’s recovery has been impressive, it is worth noting that this performance comes against a backdrop of ongoing sensitivity to global policy developments. More on that below.

Economic Growth Slows as Headwinds Mount

Beneath the surface of strong equity performance, the broader economic picture has become more nuanced. U.S. GDP growth is projected to slow meaningfully in 2025, with consensus forecasts now centering around 1.6% for the year. This represents a significant deceleration from the 2.8% growth rate recorded in 2024 and reflects a combination of cyclical and structural headwinds.

One notable factor is the impact of tariffs, which have contributed to higher input costs for businesses and have begun to filter through to consumer prices. While the second quarter is expected to show a mechanical boost to GDP—largely due to front-loaded economic activity ahead of tariff implementation—underlying momentum appears to be fading. Consumer demand, which has been a pillar of economic resilience, is showing signs of softening as higher prices erode purchasing power.

Business investment has also moderated, with many firms adopting a cautious stance in the face of policy uncertainty and rising costs. Hiring activity, while still positive, has slowed compared to previous quarters. These trends suggest that the economy is entering a period of slower, more uneven growth, with risks skewed to the downside as we move into the second half of the year.

Inflation Remains Elevated and Labor Market Conditions Weaken

Inflation continues to be a central challenge for policymakers and market participants alike. Price pressures have proven more persistent than anticipated, with OECD-wide inflation projected at 4.2% for 2025. In the U.S., the effects of tariffs and supply chain adjustments are expected to keep inflation elevated for the foreseeable future, further squeezing household budgets and compressing corporate profit margins.

The labor market, which had been a source of strength in recent years, is beginning to show signs of strain. Job growth has slowed and the unemployment rate is projected to rise to 4.7% or 4.8% by year end. Businesses are responding to higher costs and uncertain demand by restraining hiring and, in some cases, reducing headcount. These developments are being closely watched by the Federal Reserve, which has opted to keep interest rates steady for now, while awaiting clearer evidence of inflation moderation before considering any adjustments to monetary policy.

It is important to recognize that the interplay between persistent inflation and a softening labor market presents a complex policy challenge. The Federal Reserve’s current stance reflects a delicate balancing act: maintaining price stability without unduly constraining economic growth. The path forward will depend on how quickly inflationary pressures subside and whether the labor market can stabilize in the face of slowing demand.

Looking Ahead

As we enter the second half of 2025, investors face a landscape characterized by both opportunity and uncertainty. The stock market’s resilience in June is a testament to the adaptability of businesses and the enduring appeal of innovation-led sectors. At the same time, the broader economic environment remains challenging, with slowing growth, persistent inflation and evolving policy dynamics all at play.

We will continue to monitor these developments closely and provide you with timely updates as the situation evolves.

Thank you for your continued trust and partnership.

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through June 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes are unmanaged and cannot be directly invested into. Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification. The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange.

Does past performance matter?

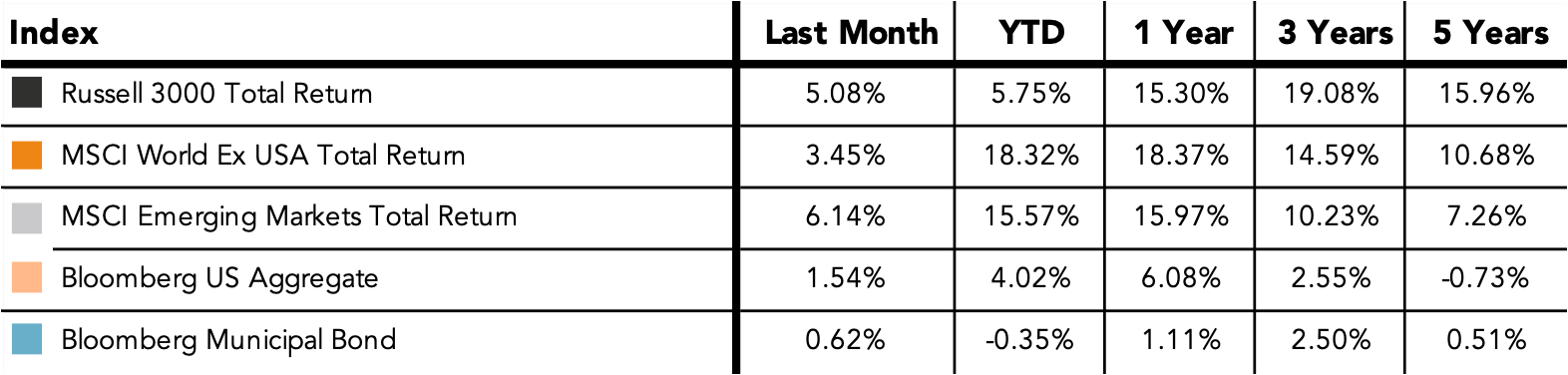

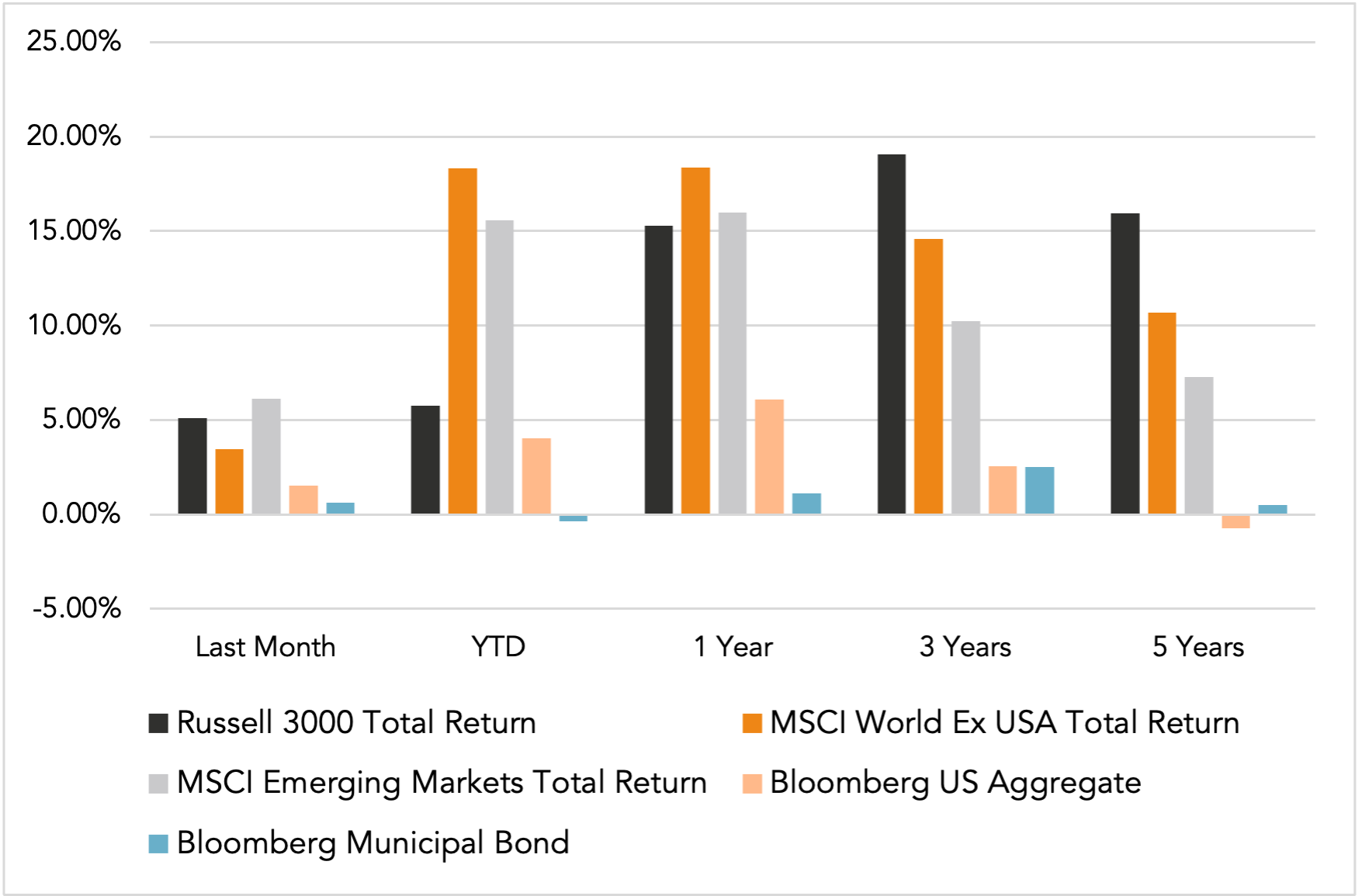

Major Market Index Returns

Period Ending 7/1/2025

Multi-year returns are annualized.

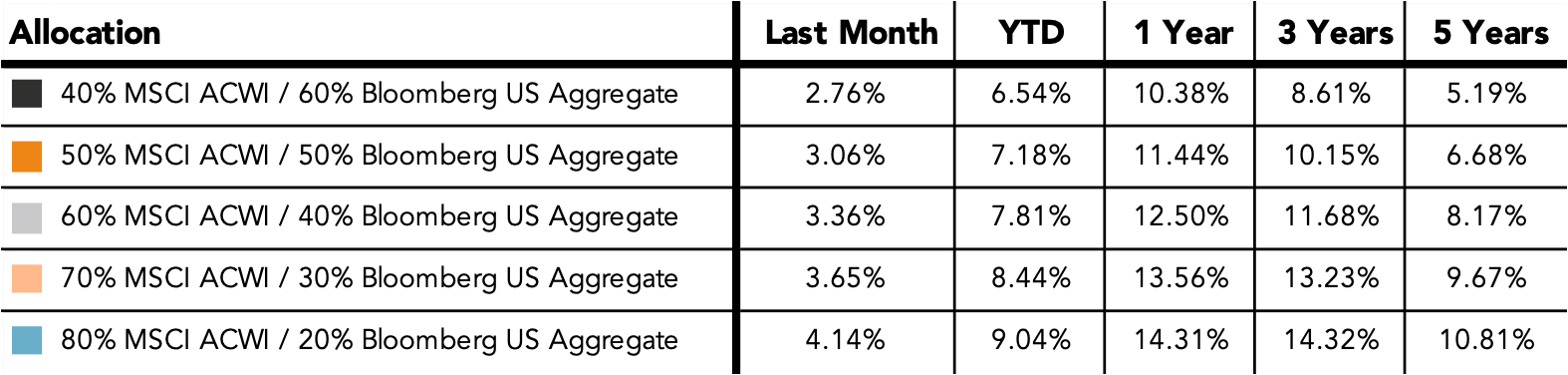

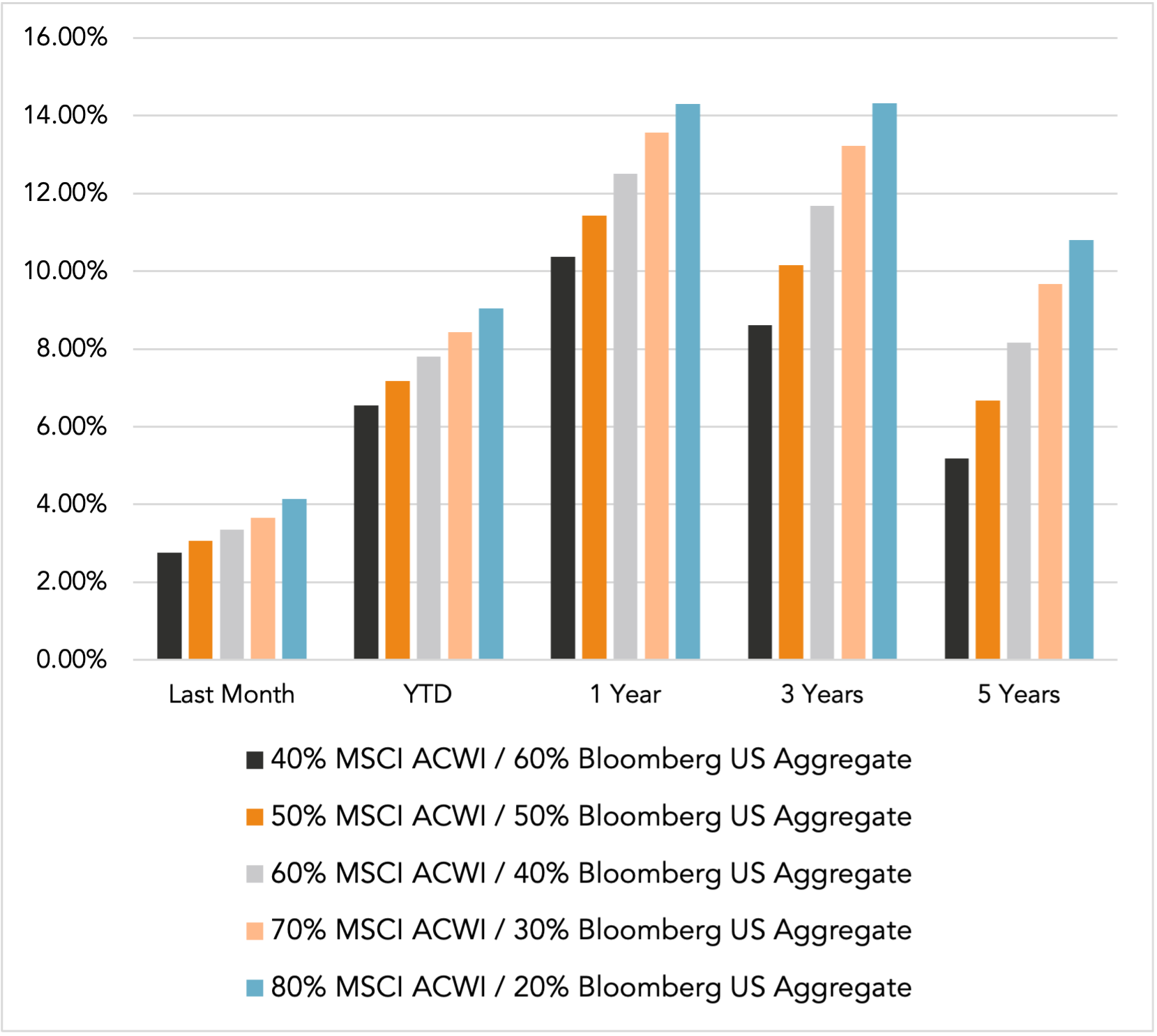

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – October 2025