Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

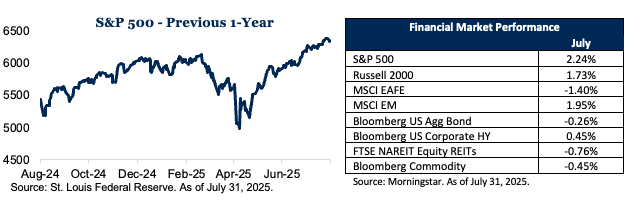

Market Update: July 2025 In Review

Key Observations

- July saw the stock market rally expand to include not just technology leaders, but sectors like industrials and smaller-cap stocks. This broadening followed prior tariff-driven volatility, signaling a possible strengthening economic foundation.

- Job growth slowed sharply in July, with unemployment rising to 4.2%. Downward revisions to previous months’ employment data suggest mounting labor market fragility.

- Ongoing tariff measures and a split among Fed policymakers fueled continued market volatility. Trade tensions and shifting policy stances contributed to uncertainty for businesses and investors.

After several months of heightened market attention to technology leadership, policy shifts and the trajectory of inflation, July provided a mix of fresh dynamics—both in financial markets and the economic landscape. Below, we summarize the month’s most significant developments and outline what shaped the investment environment.

Market Recap

Market Leadership Broadens: Beyond Big Tech

Throughout much of this year, large technology firms—particularly those with artificial intelligence (AI) businesses—have been central to the U.S. stock market’s advances. However, July marked a noteworthy shift. The equity rally expanded beyond the dominant tech sector, with increased participation among industrials, smaller-cap companies and other segments historically less correlated with the performance of technology giants.

This broadening of leadership came after the volatility experienced in prior months due to renewed trade tensions and tariff announcements. While the S&P 500 and Nasdaq each reached new highs, market observers highlighted the stronger performance of cyclical stocks. These included select industrials, financials and transportation firms—businesses closely tied to the economic cycle.

Reports point to solid earnings from several non-tech companies, with management teams citing improved order books and normalized supply chains as tailwinds during the month.

The broader market rally sparked optimism around the potential durability of the economic expansion. Historically, periods where market advances are concentrated among a handful of very large firms can leave equities vulnerable to sector-specific risks. Conversely, rallies involving a wider array of companies and sectors have often reflected growing confidence in the fundamentals of the economy.

That said, analysts remain divided as to whether this rotation signals a true turning point, or a temporary response as investors recalibrate positioning following recent volatility.

Labor Market Shows Signs of Strain

Economic indicators during July pointed to a cooling U.S. labor market. According to government data, job creation slowed markedly, with the economy adding just 73,000 jobs—well below expectations and the slowest pace in nearly two years. The national unemployment rate inched upward to 4.2%, compared to 4.1% in the previous month.

Notably, the data showed not only the disappointing pace of job gains but also meaningful downward revisions to prior months’ employment figures. These adjustments suggest that the jobs market was not as robust earlier in the year as initially thought.

Several analysts have reported growing caution among businesses, with anecdotal evidence of hiring freezes in certain sectors and a deliberate slowdown in workforce expansion.

Factors driving this shift include persistent policy and trade uncertainties, along with tighter immigration enforcement, which may have complicated workforce planning for certain industries—particularly those that rely on skilled labor from abroad. Despite the cooling trend, wage growth has remained broadly stable, helping to support consumer spending for now.

However, the softening labor picture is being watched closely by market participants for potential spillover effects on economic growth and corporate profits in the months ahead.

Market Volatility Fueled by Policy and Trade Uncertainty

Another element influencing financial markets in July was a resurgence of policy-related uncertainty and waves of market volatility tied to international trade disputes.

The Federal Reserve left interest rates unchanged at its July meeting, maintaining a cautious approach as it weighed mixed economic signals. However, there was an unusually public split among Fed policymakers regarding future policy direction, which heightened uncertainty across markets.

Compounding this uncertainty, the U.S. administration announced several new trade measures in July, including a 50% tariff on copper imports and renewed negotiations with key trade partners. These policies were implemented amid ongoing debate over their likely effectiveness and potential impact on both global supply chains and domestic manufacturers.

Markets responded with short bursts of volatility following tariff announcements, as investors assessed the implications for input costs, corporate margins and economic growth.

For much of the month, news flow around potential further tariffs and speculation over shifts in the Fed’s monetary policy stance contributed to choppy market conditions. Sectors exposed to global supply chains, such as industrials and materials, exhibited higher price swings. At the same time, some multinational firms delayed investment decisions as they awaited greater clarity on the evolving trade landscape.

Even as the broader equity market advanced, these policy and trade uncertainties were a source of ongoing caution for business leaders, analysts and investors alike. Market participants remain attentive to the risk that renewed escalations—whether in the form of additional tariffs or abrupt shifts in policy—could inject fresh volatility into both financial markets and the real economy.

Economic and Market Outlook

Taken together, the events of July paint a picture of markets searching for equilibrium amid competing crosscurrents. The widening equity rally, reaching beyond the largest technology firms, suggests a degree of resilience across segments of the economy. Improved fortunes for industrials and other non-tech sectors hint at normalization in supply chains and a more balanced investment landscape.

However, these positives are set against the backdrop of a softening labor market and the unpredictable trajectory of trade and policy actions. Investors and business leaders remain vigilant, with an eye on potential inflection points in economic data and policy signals.

For now, wage growth and consumer activity have been supported even as employment growth moderates—but the sustainability of these trends will depend on labor market developments as we move through the third quarter.

Financial market participants continue to monitor the Federal Reserve’s communications for clues about the future path of interest rates. They’re also watching August’s data releases for further signs of labor market health and headline inflation.

Meanwhile, companies are adjusting to the evolving tariff regime, and any additional policy measures from Washington will be scrutinized carefully for their potential market and real economy impacts.

If you have any questions about this update or would like to discuss specific aspects in greater detail, please do not hesitate to reach out to your advisory team.

Thank you for your continued trust.

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or a recommendation of any kind. The commentary represents an assessment of the market environment through July 2025.

The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC are generally employees. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Indexes referenced are unmanaged and cannot be directly invested into.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification.

Does past performance matter?

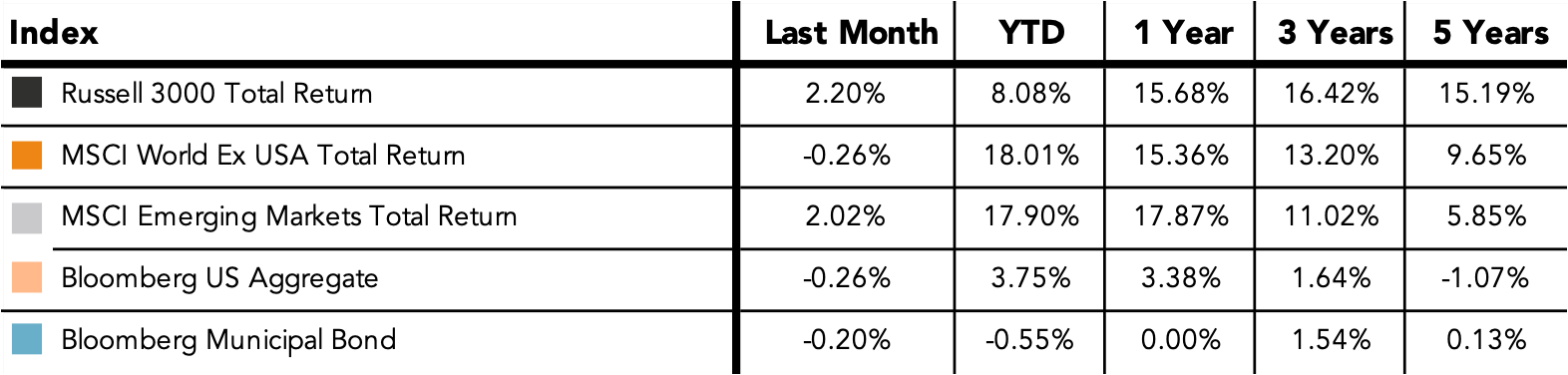

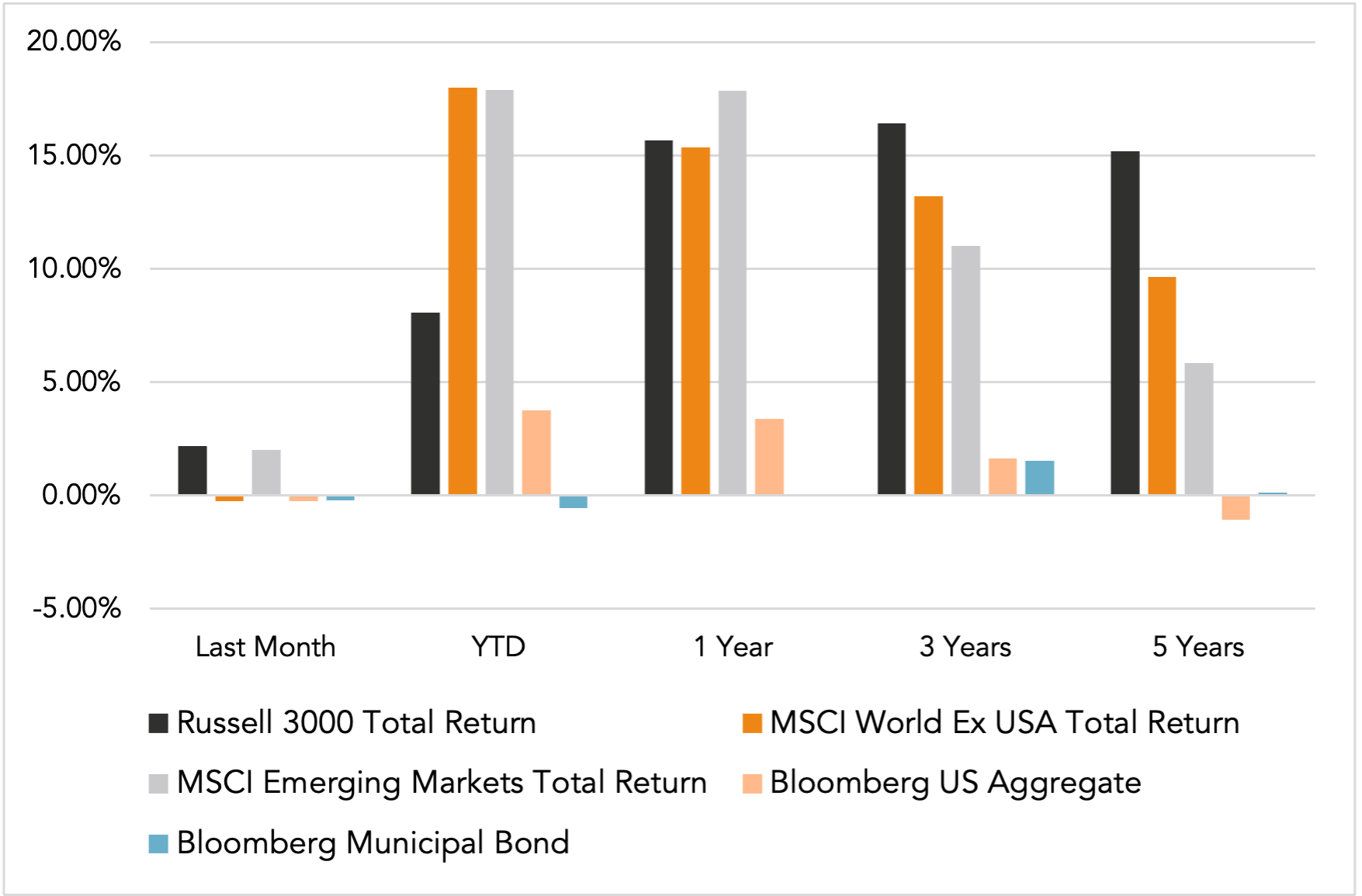

Major Market Index Returns

Period Ending 8/1/2025

Multi-year returns are annualized.

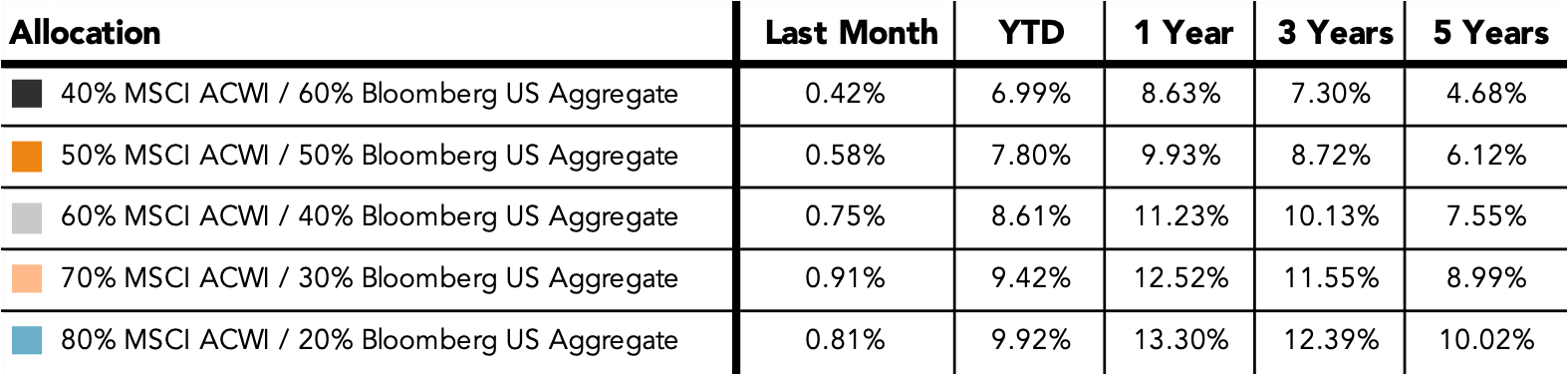

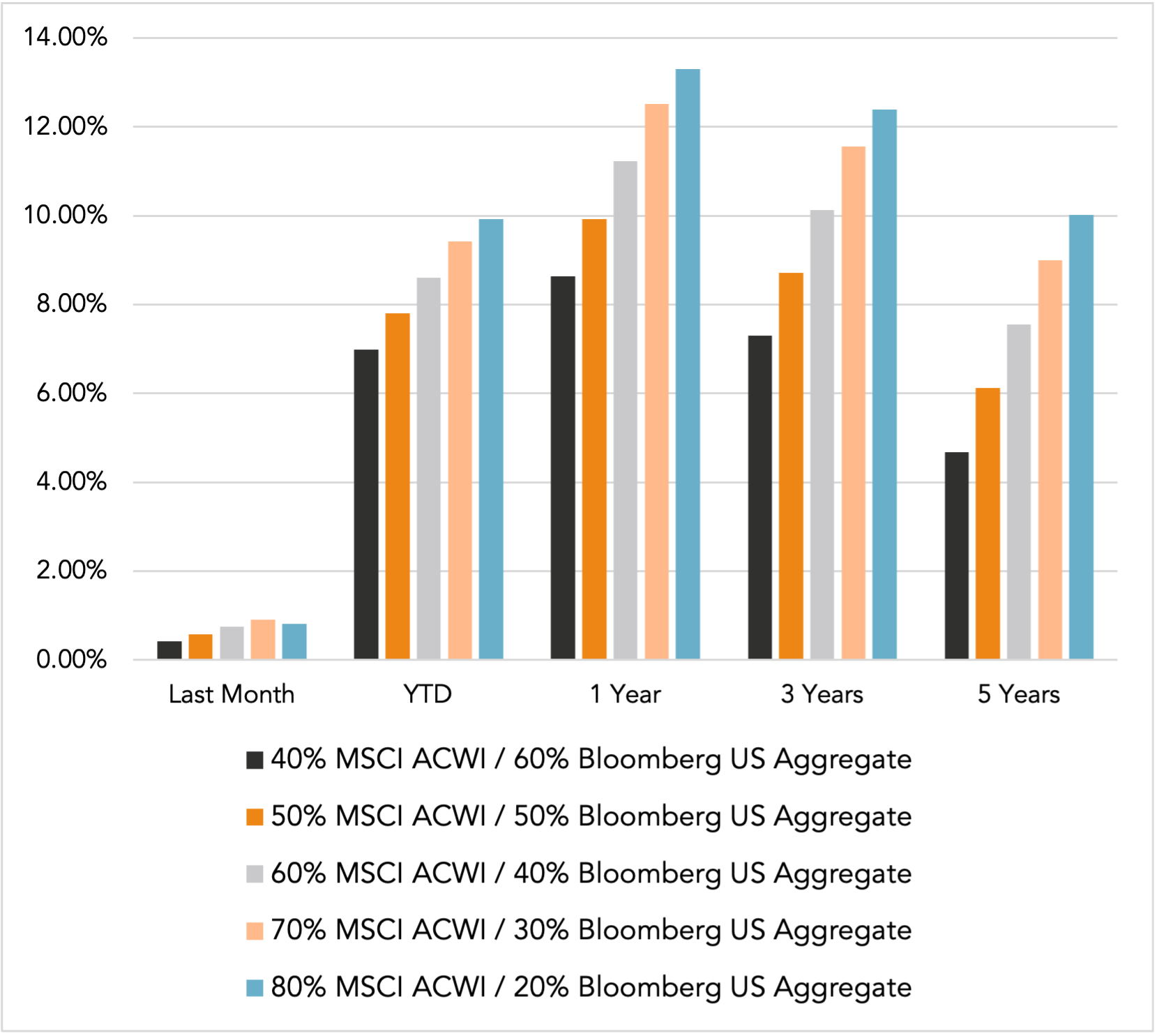

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

Monthly Market Update – January 2026