Social Security can feel like a financial footnote for wealthier individuals and couples. But while the federally provided benefits may seem trivial alongside other assets, they can easily exceed $1 million over the lifetimes of high-earning couples. There are plenty of good uses for such sums of money—and with careful planning, it’s possible to maximize both the amount you receive and minimize the taxes you’ll pay on it.

Why It’s Worth the Wait

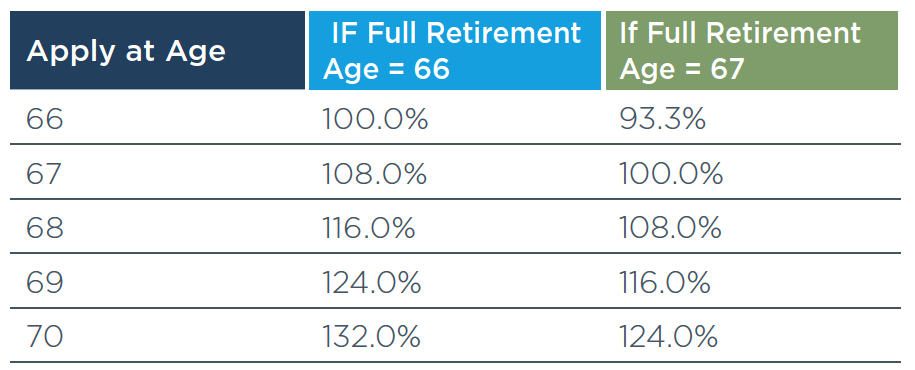

You are eligible to start drawing a monthly Social Security retirement benefit as early as age 62. But that amount will be progressively higher in each of the next eight years. For example, let’s say that your monthly benefit at age 67, which the Social Security Administration considers “full retirement age,” is $3,402. This assumes you were born in 1965 and your highest income level was $500,000. If you opt to start receiving benefits at age 62, that amount will be just $2,396. But if you wait until age 70, the amount is capped at $4,1941. The government calculates your full-retirement-age benefit based on your lifetime earnings; it then adds to or subtracts from that amount based on the number of years before or after age 67 you start receiving the benefit. Once you reach age 70, the benefit will max out and it won’t make sense to delay further.

Make Sure It’s Time

Once you file for Social Security, you will have set the base for the benefit level you’ll receive throughout the rest of your life. Uncle Sam does provide annual cost-of-living adjustments, however: For 2022, monthly payments increased 5.9%2, and an adjustment in the 8% to 10% range is expected for 20233. In some cases, you may be entitled to higher benefits if you continue to work after filing for benefits. But it’s important to understand that there typically aren’t do-overs once you’ve put your monthly payments in motion.

The Government Taketh Away

If you earn a high income, you should expect most of your Social Security income to be subject to tax. The taxable amount depends on your combined income from Social Security and other sources. And the thresholds are low. If a couple’s combined gross income exceeds $44,000, then the maximum percentage of their Social Security income—85%—is subject to federal tax. It’s worth noting that wealthy taxpayers could wind up paying more into the Social Security system in the not-too-distant future. The system has long faced a funding strain, and a recent congressional proposal seeks to expand the Social Security payroll tax. Currently, such taxes apply to the first $147,000 of income; the proposal seeks to raise the income ceiling to $400,0004.

You Can Limit the Tax Hit

The key to minimizing taxes on your Social Security benefit is to reduce your total taxable income. Your wealth advisor can walk you through several strategies. One option is to shelter some retirement income in Roth accounts in anticipation of receiving Social Security in the future. Contributions to Roth IRAs and Roth 401(k)s are made with money that has already been taxed. Any earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement. As a reminder, distributions from Roth IRAs are tax-free as long as you’re at least 59½ and have owned the account for at least five years.* Because Roth payouts aren’t taxable income, they won’t increase the tax you owe on your Social Security benefits.

Planning for Married Couples

Married couples need to decide which spouse will tap their benefits first. Generally speaking, the math favors the lower earner collecting first, which allows the higher earner’s benefit to continue appreciating. When the higher-earning spouse’s benefit has fully appreciated, he or she can begin receiving benefits, and the spouse can make the switch to spousal benefits.

Claiming Survivor Benefits

When a Social Security beneficiary dies, their surviving spouse is eligible for survivor benefits. In most cases, a partial benefit is available when the survivor is age 60 or older. If the surviving spouse has reached full retirement age, he or she is entitled to 100% of the deceased spouse’s benefit or his or her own benefit, whichever is higher. If a widow or widower has a disability and is age 50 through 59, they are eligible for 71½% of the deceased spouse’s benefit.5

When You Don’t Need the Money

Wealthier individuals and couples often don’t need Social Security income to cover their expenses. But there are still plenty of good ways to put that money to work. A Social Security income stream might be used for estate planning purposes, for instance. One popular strategy involves funding a life-insurance policy whose proceeds will cover estate taxes or be used for charitable gifts. Social Security benefits can also be used to fund long-term care insurance. Medical care for serious chronic illness can be extremely expensive; for example, the median annual cost of a semi-private room in a nursing home for 2021 was about $95,000.6 Such care isn’t generally covered by traditional insurance.

Don’t Overlook Social Security

As a guaranteed lifetime income stream, Social Security is worth planning for, even for wealthy households. Even if you plan to ultimately give your benefits away, it makes sense to maximize them so that you can give more to the people or causes that are most important to you. Your AdvicePeriod wealth advisor is ready to help you make the most of this often-underappreciated asset.

Footnotes

1 “What is the Maximum Social Security Benefit Payable?”

2 “How Much Will the COLA Amount Be for 2022 and When Will I Receive It?”

3 “Social Security COLA 2023: How Much Will Benefits Increase Next Year?”

4 “Wages Up to $147,000 are Currently Taxed for Social Security. How That Could Change”

*The IRS treats a Roth withdrawal made more than five years after the first tax year in which you made a contribution (including earnings) as a “qualified distribution.” This means it is not taxable or subject to a penalty as long as you satisfy one of these qualifying conditions: You’re at least 59½, you become disabled or pass away, or you use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

The information contained herein is not intended to be personalized investment or tax advice or a solicitation to purchase any investment or insurance product or engage in a particular financial or investment strategy. The views expressed are for informational and educational purposes only and do not consider any individual personal, financial, or tax considerations. Information obtained from third-party sources is believed to be reliable, but no representation is made regarding their completeness or accuracy. Please consult a financial professional before making any financial-related decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.