Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Monthly Market Review

By Nathan Sonnenberg

AdvicePeriod Chief Investment Officer

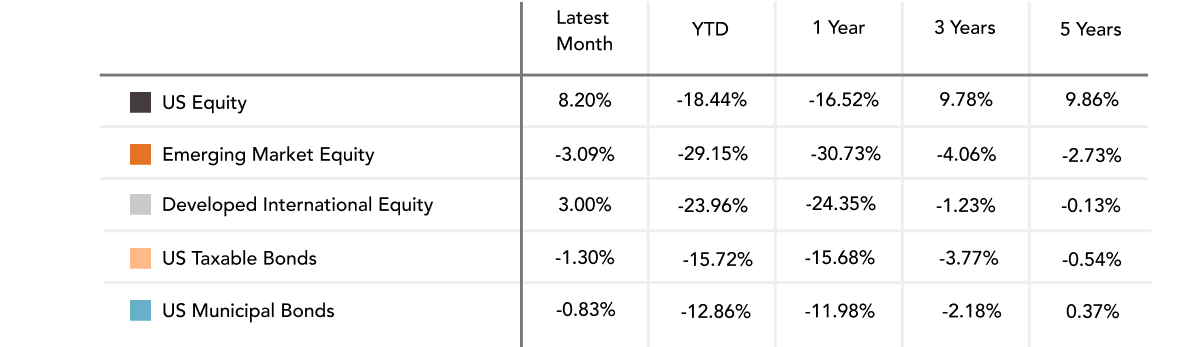

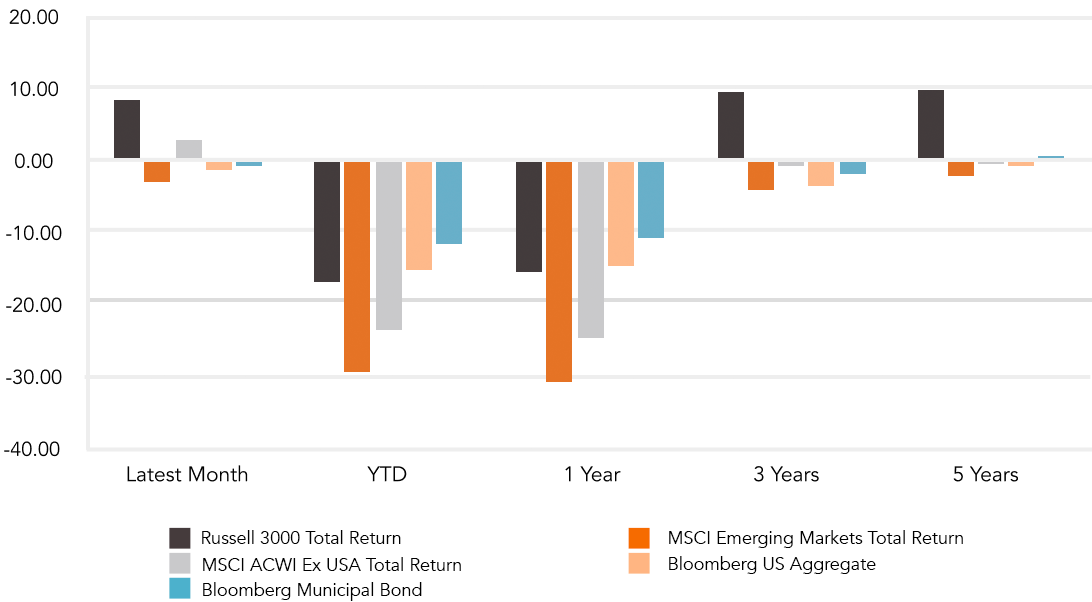

Stocks bounced back strongly in October, with almost all major equity markets making solid gains.

The S&P 500 advanced by 8.1%, while the Dow Jones Index of 30 stocks ended October up 14.1%, one of its best months in years. The tech-heavy Nasdaq 100 index, which has been hit especially hard this year, posted a 4.0% return. Meanwhile global equities, as measured by the MSCI All-Country World Index, gained 3.0%. Emerging-market stocks disappointed, however, falling 3.1% in October. A sell-off of Chinese stocks after the confirmation of a third term for Xi Jinping as general secretary of the Chinese Communist Party drove the negative performance.

While stocks mostly rose, bonds headed in the opposite direction, as rising interest rates drove down prices and increased yields. The Bloomberg U.S. Aggregate Bond Index fell by 1.3%, and the S&P National AMT-Free Municipal index lost 0.7%. On the bright side, higher interest rates mean investors can now earn 3.0% in money market funds and 4.0% or more on short-term Treasury bills.

To advance in October, stocks overcame the powerful headwinds of high inflation and rapidly rising interest rates. With those pressures remaining, it’s unclear whether stocks’ momentum will continue. The Federal Reserve raised a key short-term interest rate by 0.75% on November 2, the fourth consecutive hike of that magnitude. The move, aimed at reining in stubborn, four-decade-high inflation, brings the Fed’s year-to-date increases to 3.75%, and the central bank has signaled that further rate increases lie ahead.

Spurred by the Fed’s actions, U.S. Treasury yields rose in October, with the 10-year bond rising to 4.1% and the 30-year yield increasing to 4.2%. Rising rates have slammed the housing market, where the average rate on 30-year mortgages recently topped 7.0%, more than double pre-pandemic rates. Home contract signings fell in September for the fourth month in a row, according to the National Association of Realtors.

The good news is that fast-rising rates have not, at least so far, tipped the economy into recession. The economy expanded in the third quarter at an annualized rate of 2.6%, and the Atlanta Fed projects gross domestic product growth of 2.9% in the fourth quarter. In the meantime, retail sales remain stable and job growth remains solid: Employers added 261,000 new jobs in October, and the unemployment rate is a healthy 3.7%.

Furthermore, there are encouraging signs on inflation. The prices paid by businesses have now declined for seven consecutive months. Food prices have fallen for six straight months. And supply chain bottlenecks issues have eased for five months in a row. Still, prices for oil and natural gas remain elevated compared with a year ago, and wages are still increasing, a dynamic that can drive broad price inflation.

Moving forward, investors will keep a close eye on inflation and the Fed but also corporate earnings. As of late October 28, 52% of S&P 500 companies had reported results, with 71% reporting higher-than-expected earnings-per-share. There’s little doubt that equity markets will remain volatile. But maintaining investment discipline is critical during volatile times and will leave portfolios well-positioned once the current bear market ends.

Definitions:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Dow Jones Industrial Average (DJIA) is an index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The Nasdaq 100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization.

The MSCI All Country World Index (ACWI) is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed and emerging market countries.

The Bloomberg U.S. Aggregate Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities.

The S&P National AMT-Free Municipal Bond Index is a broad, comprehensive, market value-weighted index designed to measure the performance of the investment-grade tax-exempt U.S. municipal bond market.

Disclosures:

The indices referenced are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary represents an assessment of the market environment through October 2022. The views and opinions expressed may change based on market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize.

The commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. Please consult a financial professional before making any financial-related decisions.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Does past performance matter?

Major Market Index Returns

Period Ending 11/1/2022

Multi-year returns are annualized.

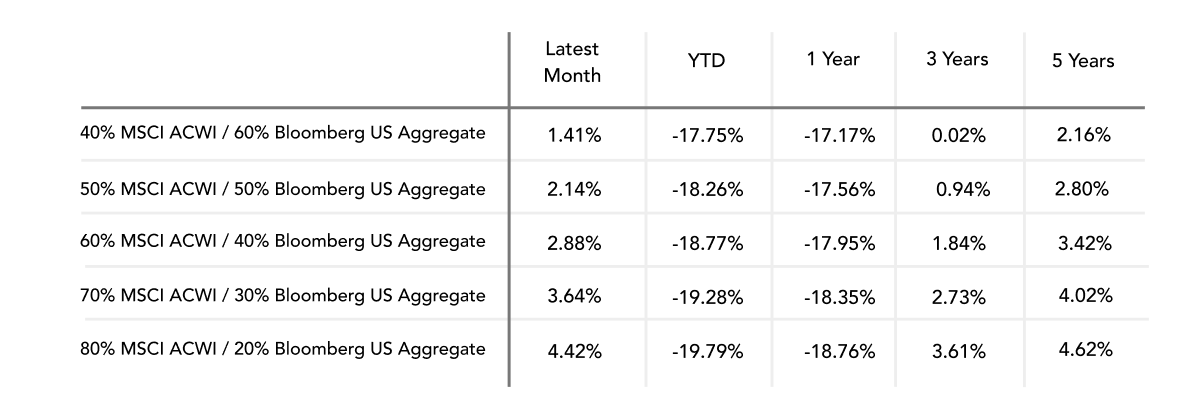

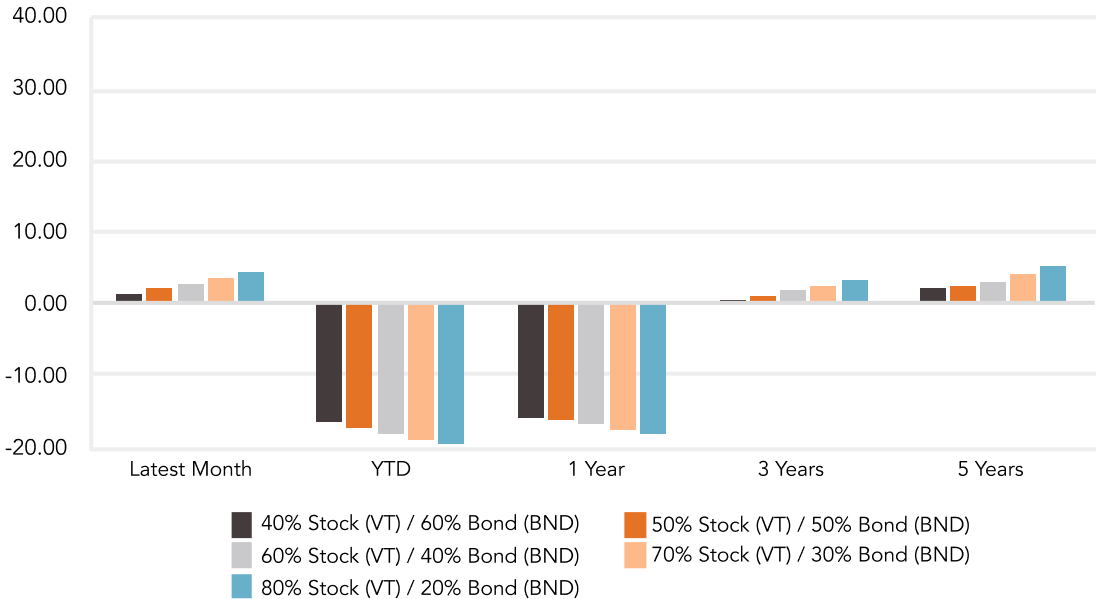

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

What You Pay For: The Percentage of Active Managers That Underperform Their Benchmarks

Trailing 10 Years Numbers As of December 31st, 2021 – S&P Spiva Scorecard

Percentage of US large-cap funds that underperformed their benchmarks

US large-cap benchmark:

S&P 500

Percentage of international funds that underperformed their benchmarks

International benchmark:

S&P International 700

Percentage of emerging market funds that underperformed their benchmarks

Emerging Markets benchmark:

S&P/IFCI Composite

The SPIVA Scorecard is a robust, widely-referenced research piece conducted and published by S&P DJI that compares actively managed funds against their appropriate benchmarks on a semiannual basis.

April 2024 Market Commentary