Please find our most recent market review below. We hope these perspectives are valuable to you.

– The AdvicePeriod Team

Banking Sector Troubles – Assessing the Impact

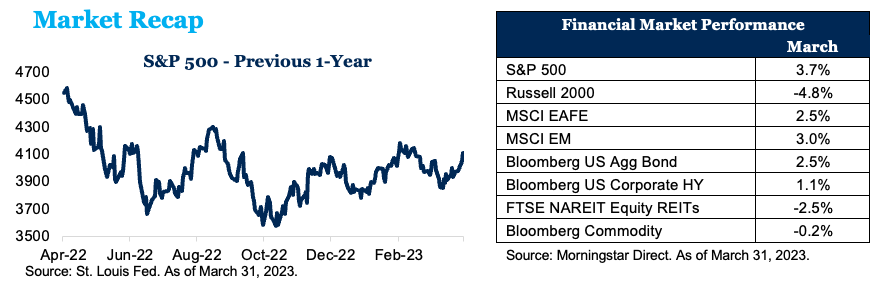

Turmoil in the banking sector drove the stock market lower in March, while the fixed income market rallied in anticipation of the end of the Federal Reserve’s rate-hiking cycle.

Key Observations

- The stock market was modestly higher in March.

- Small-cap stocks were hit hard due to economic concerns.

- Bonds ended the month higher as yields fell.

- International markets posted a modest gain, with emerging markets outperforming developed markets.

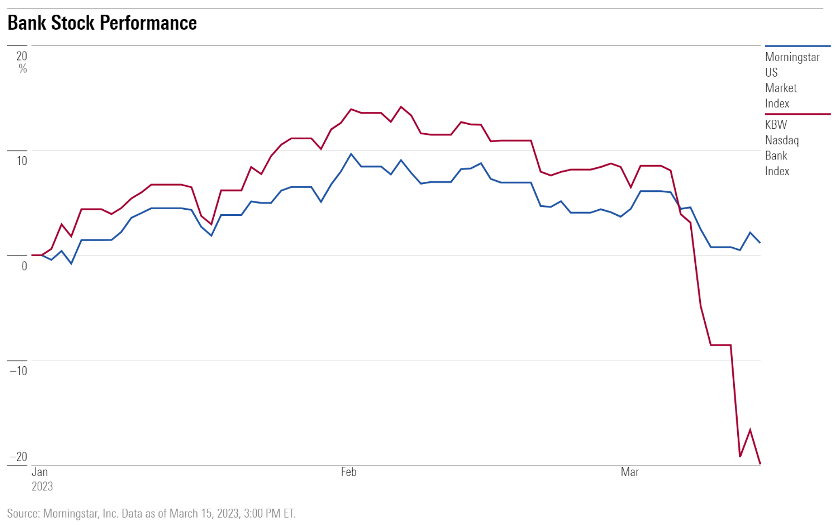

- The KBW Banking Index dropped 24.9% in March.1

The collapse of Silicon Valley Bank (SVB), Signature Bank and Credit Suisse, a large Swiss bank, triggered significant volatility in March. Notably, the divergence of different asset classes was quite unusual. On the positive side, bonds rallied in anticipation of the end of the Federal Reserve’s rate-hiking cycle. The Bloomberg U.S. Aggregate Bond Index gained 2.5% for the month while yields dropped across the board: 2-year Treasury yields, which began the month at 4.89%, dropped to 4.04%, and the 10-year Treasury yield fell from 4.00% to 3.47%. Growth stocks, which are especially sensitive to interest rates, soared 6.8% as measured by the Russell 1000 Growth Index. Small- and mid-cap stocks fell 4.8% and 1.5%, respectively, as concerns grew that the economy is inching closer to recession and due to their increased exposure to regional banks. The KBW Bank Index dropped 24.9% for the month as investors fled the sector. International markets ended the month with moderate gains, underperforming the U.S. market.

The collapse of Silicon Valley Bank (SVB), Signature Bank and Credit Suisse, a large Swiss bank, triggered significant volatility in March. Notably, the divergence of different asset classes was quite unusual. On the positive side, bonds rallied in anticipation of the end of the Federal Reserve’s rate-hiking cycle. The Bloomberg U.S. Aggregate Bond Index gained 2.5% for the month while yields dropped across the board: 2-year Treasury yields, which began the month at 4.89%, dropped to 4.04%, and the 10-year Treasury yield fell from 4.00% to 3.47%. Growth stocks, which are especially sensitive to interest rates, soared 6.8% as measured by the Russell 1000 Growth Index. Small- and mid-cap stocks fell 4.8% and 1.5%, respectively, as concerns grew that the economy is inching closer to recession and due to their increased exposure to regional banks. The KBW Bank Index dropped 24.9% for the month as investors fled the sector. International markets ended the month with moderate gains, underperforming the U.S. market.

The Fed raised rates another 25 basis points at its March meeting and said that “some additional policy firming may be appropriate.” Federal Open Market Committee members indicated that only one member thought that rates should stay where they are, 10 thought they should be raised another 25 basis points and seven wanted even more tightening after that. Chairman Powell said he did not anticipate any rate cuts this year, but the market does not believe him. Currently, the futures market is forecasting a fed funds rate of around 4.00% this year, which implies several rate cuts.

Did the Fed Finally Break Something?

Markets were rocked in March by the collapse of SVB, Signature Bank and Credit Suisse. It is important to point out that the primary problem in the banking sector is not bad loans or credit risk—which was the case during the Global Financial Crisis—but a crisis of confidence triggered by a mismatch of assets and liabilities.

Banks take deposits and use them to fund loans and make investments. Over the last year, the Fed’s aggressive interest-rate hikes have inflicted big losses on bonds bought by banks when interest rates were much lower. This “interest rate risk” is something well-run banks tend to carefully manage. SVB and Signature were banks that were widely considered to be poorly run (while Credit Suisse is a bank that has been rocked by multiple scandals in recent years), and both SVB and Signature Bank saw their deposits drop as the technology and crypto companies they primarily serve struggled.

Once the market learned that SVB had done a poor job managing its bond portfolio, this led to a “run” on the bank (too many depositors withdrawing their money all at once). The Federal Deposit Insurance Corporation (FDIC) was created during the Great Depression for the primary purpose of avoiding a run on the bank.

The Fed has created a backstop it calls a new Bank Term Funding Program, which allows eligible banks to borrow for up to one year pledging Treasuries and agency MBS, which will be valued at par, as collateral. That plugs a $620 billion hole created by the unrealized losses on banks’ securities holdings. Any losses to the FDIC will be covered by a special assessment on banks, not taxpayers. Additionally, the government will fully protect both insured and uninsured depositors of SVB and Signature Bank, which have both been closed.

The Fed has never defined “sufficiently restrictive,” but the view that is widely held in the markets is that three bank failures in a week will likely mark the end—or nearly the end—of the Fed’s rate-hiking cycle. Market rates across the yield curve fell abruptly this month in anticipation of the Fed backing off and a slowing in economic growth.

The Fed revised down its projection for real GDP growth this year to 0.4% from the 0.5% it had forecasted in December. Given that the GDPNow Model from the Federal Reserve Bank of Atlanta is currently tracking at a 3.2% annualized growth rate for Q1, this implies negative average real GDP growth for the rest of the year. The Fed also projects the unemployment rate to rise to 4.5% at the end of the year from 3.6% currently. Assuming no change in the labor force, this implies an increase of more than 1.5 million in the number of unemployed. Additional tightening in credit conditions in response to bank deposit outflows further magnifies the risk of recession.

Outlook

Historically, the S&P 500 has peaked about seven months ahead of recession,2 which helps explain the poor performance of the stock market over the past 12 months. In other words, the market leads the economy both in and out of recessions. These moves are impossible to predict with any precision. For that reason, we continue to believe the best advice for investors with long-term goals is to stay the course, stay invested and be ready to take advantage of any opportunities that might arise in a market decline.

Footnotes:

1 FRED Economic Data

2 Ned Davis Research

Disclosures:

This market commentary is meant for informational and educational purposes only and does not consider any individual personal considerations. As such, the information contained herein is not intended to be personal investment advice or recommendation. Please consult a financial professional before making any financial-related decisions.

The commentary represents an assessment of the market environment through March 2023. The views and opinions expressed may change based on the market or other conditions. The forward-looking statements are based on certain assumptions, but there can be no assurance that forward-looking statements will materialize. This commentary was written and provided by an unaffiliated third party.

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

AdvicePeriod is another business name and brand utilized by both Mariner, LLC and Mariner Platform Solutions, LLC, each of which is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. Each firm is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which each firm maintains clients. Each firm may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by an advisor with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Mariner, LLC or Mariner Platform Solutions, LLC, including fees and services, please contact us utilizing the contact information provided herein or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For additional information as to which entity your adviser is registered as an investment adviser representative, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided to you. Investment adviser representatives of Mariner, LLC dba Mariner Wealth Advisors and dba AdvicePeriod are generally employed by Mariner Wealth Advisors, LLC. Investment adviser representatives of Mariner Platform Solutions, LLC dba AdvicePeriod, are independent contractors.

Index Definitions: The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index. MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs. Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume, and 1/3 by world production and weight-caps are applied at the commodity, sector, and group level for diversification. Morningstar US Market Index measures the performance of US securities and targets 97% market capitalization coverage of the investable universe. KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly traded in the U.S.

Does past performance matter?

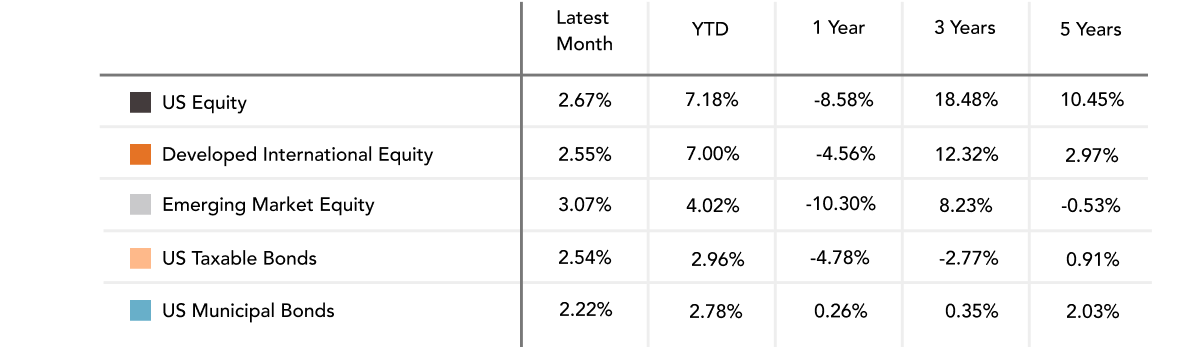

Major Market Index Returns

Period Ending 4/1/2023

Multi-year returns are annualized.

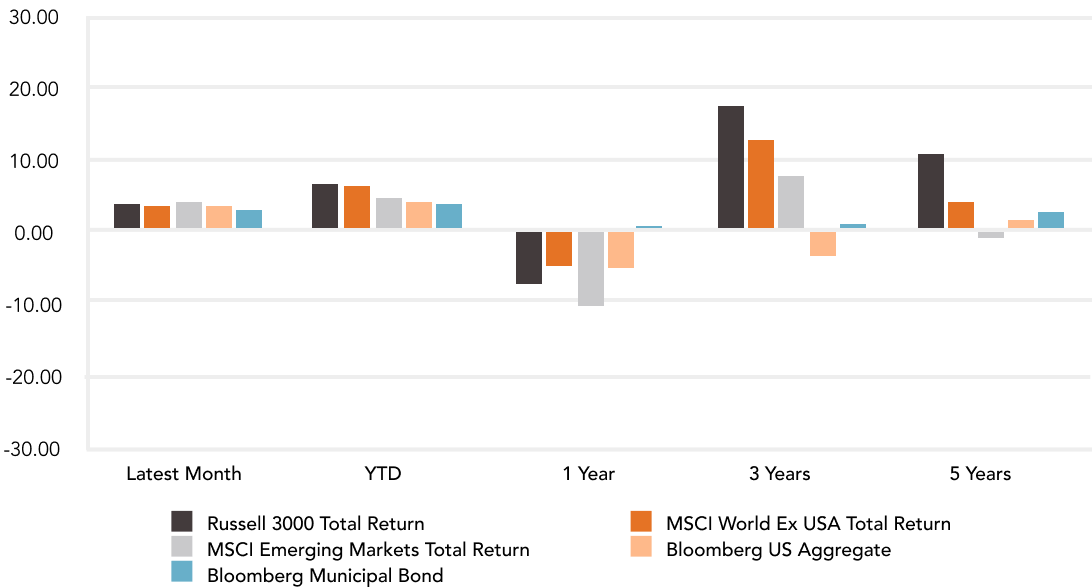

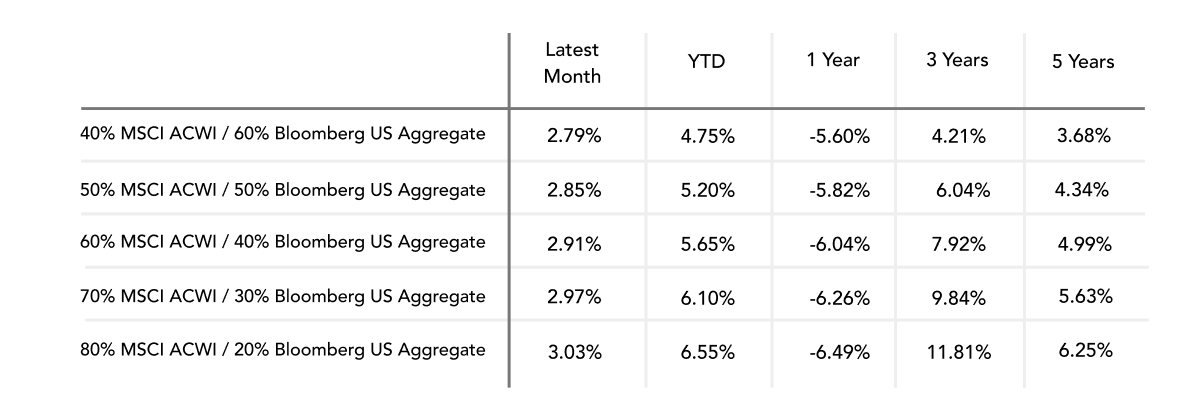

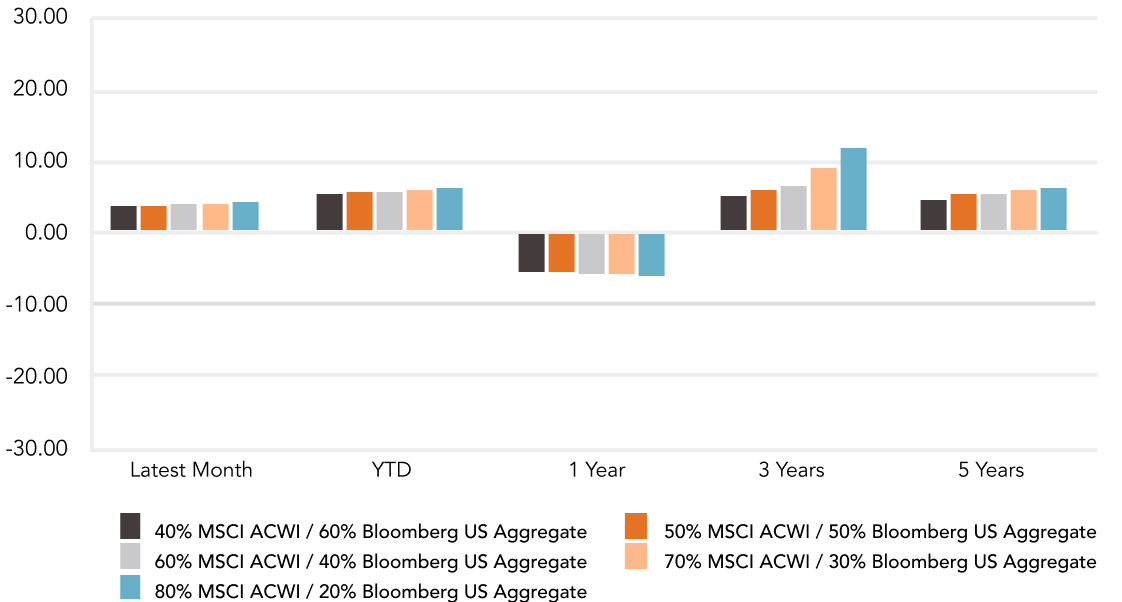

Mix Index Returns

Global Equity / US Taxable Bonds

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

The Russell 3000 Index is a United States market index that tracks the 3000 largest companies. MSCI Emerging Markets Index is a broad market cap-weighted Index showing the performance of equities across 23 emerging market countries defined as emerging markets by MSCI. MSCI ACWI ex-U.S. Index is a free-float adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding companies based in the United States. Bloomberg U.S. Aggregate Bond Index represents the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, as well as mortgage and asset-backed securities. Bloomberg Municipal Index is the US Municipal Index that covers the US dollar-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

April 2024 Market Commentary