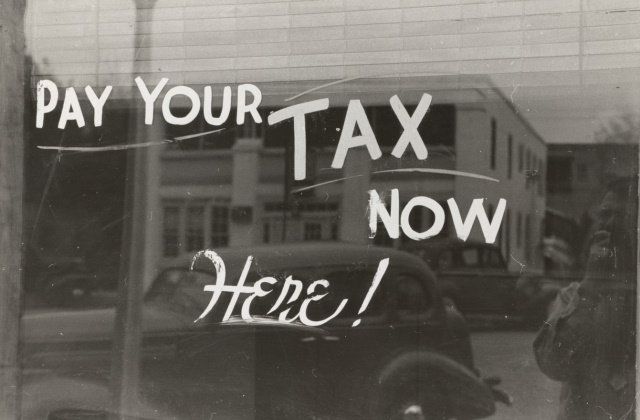

It wasn’t that long ago that stockbrokers could earn significant commissions—upwards of $100 per trade—by talking their customers into buying the latest hot stock. There were sales of touchdown bonds; securities that paid a 7% load, and loaded mutual funds that paid big trailing commissions forever.

Thankfully, those days are gone, in part to increased competition, technology, and plain ol’ consumer outrage. But most investors would be surprised to learn that some financial advisors continue to overcharge their clients. Even “fiduciary” advisors, who are legally bound to put their clients’ best interests first, regularly deliver less and charge plenty for it. To make it worse, so many advisors are stuck in the sales pitch of “I can pick a better manager for you than you can on your own” that even if their fees are fair, the underlying investments have such high fees, that any benefit of the advisor is often neutralized or worse.

How is this possible? Because too often, the fees that advisors charge bear no relationship to the amount of value provided to the clients.

While most consumers have no idea what they pay, the bliss of ignorance is quickly unveiled when transparency arrives. Imagine that you hire an advisor to manage $2 million of your money. Her annual fee is 1% of your assets, which comes to roughly $20,000 each year. A few weeks later, you find out that another client of this advisor has $1 million, thus paying just $10,000 a year—even though the same amount of work is involved in managing the two portfolios.

Wealthier clients don’t like paying more just because they have more money. That’s why leading-edge advisory firms like AdvicePeriod are committed to changing the way clients pay for advice. By tilting towards flat-fees for clients not in the accumulation phase, we strive to align what each client pays directly to the value he or she receives.

Let’s look at the evolution in how financial advisors have charged for their services. Until the mid-1980s, almost all “advisors” were technically brokers—salesmen who earned fat commissions every time a customer bought or sold a stock or bond. This model frequently created incentive to “churn” client accounts through the unnecessary and often counterproductive buying and selling of securities.

In the 1990s, “fee-based” financial advice started to gain traction. This arrangement, in which a percentage fee was charged based on the amount of underlying assets, eliminated commissions (well, not entirely—read on). An additional argument for the fee-based approach: It created incentive for advisors to protect and grow client assets. As the account grew, the advisor’s earnings from that percentage fee were magnified.

One problem with the fee-based approach is that many advisors have found wiggle room to charge commissions in some cases or create product that generates additional fees. Despite this conflict of interest, these advisors continue to call themselves fiduciaries. And, until the technical definition of a fiduciary is codified, they can as long as they disclose those conflicts. Sadly, those disclosures are typically buried in impenetrable legalese.

But the change has been a marketing boon. That’s why “fee-only” advisors have been gaining popularity over the last decade. Still, the fee-based and fee-only models can result in overcharging—or undercharging—when clients’ levels of wealth and the complexity of their needs differs.

For example, a client with $30 million may require portfolio management as well as extensive tax and estate-planning guidance. Another client with $30 million may simply want her advisor to manage her portfolio because it’s all going to charity. Is it fair for an advisor to charge each of these clients the same rate when the service requirements are so vastly different?

We believe the solution to this problem is a flat fee, representative of the value added and complexity associated with the relationship. Our clients who have completed the accumulation phase of their wealth pay a flat annual fee based on the complexity of their situation and our ability to add value. They pay for our advice. Period.

At AdvicePeriod, innovations such as our flat fee grow directly from our commitment to our clients’ best interests. We believe that to call ourselves fiduciaries, we must continually earn our clients’ fees—and their trust. We strive to embody the true meaning of fiduciary; not just the legal definition.